Saving faster with the First Home Super Saver scheme

Find out if you're eligible

Make extra contributions

Apply to withdraw

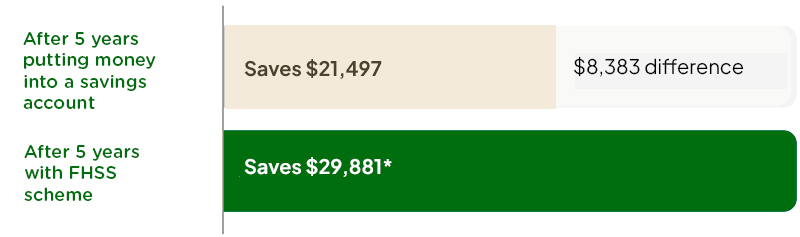

How Carly saved an extra $8,383 with the FHSS scheme

| Carly contributed $6,000 per year to her super under the FHSS | After 5 years of contributing via FHSS, she saves $29,881 | By saving via the FHSS, she saves an additional $8,383 to put towards her deposit |

|---|---|---|

| Extra contribution (using salary sacrifice) | Savings account | |

| Year 1 | $5,102 | $4,050 |

| Year 3 | $16,596 | $12,516 |

| Year 5 | $29,881 | $21,497 |