Shares were again the star performers

Rest’s Core Strategy and most of our diversified portfolios performed well, driven by another strong year of returns in shares. Overseas shares were led by large US technology companies, buoyed by advances in artificial intelligence, while in Australia, the technology and financial sectors were top performers.

Strong share markets delighted investors even though inflation proved to be stubborn! The global economy has held up well and most major markets have followed, resulting in gains across shares and other asset classes. Global central banks are keeping interest rates at higher levels to help achieve their inflation targets. Despite the higher interest rates and the pressures from a higher cost of living, robust employment in many developed markets is helping people to keep spending, one of the main drivers of economic growth.

We increased our exposure to overseas shares across the diversified options during the year. This included investments in some of the largest listed companies in the US, which went on to post strong returns in FY2023-24.

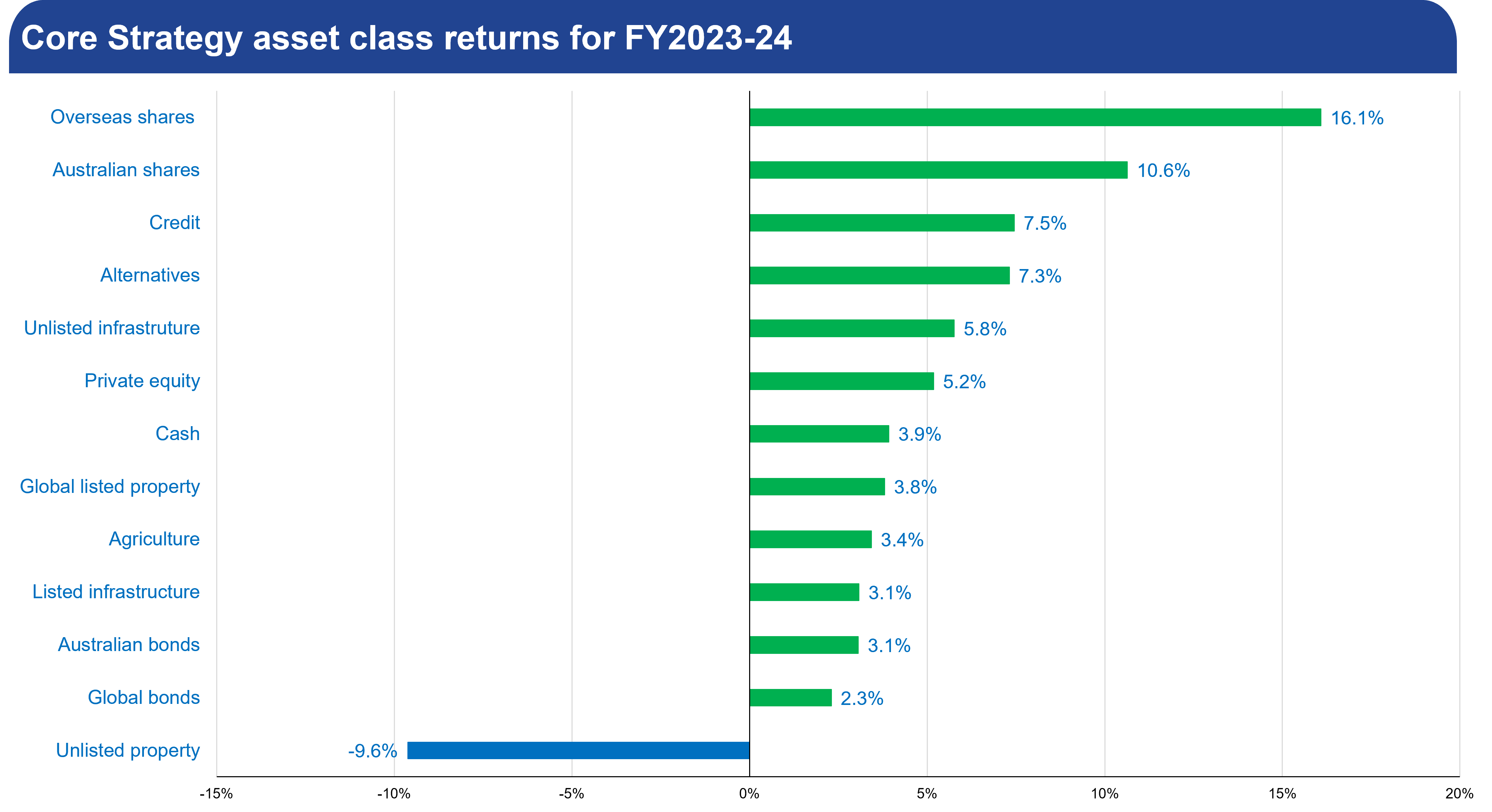

The graph below shows the performance of the asset classes we invest in. We can see that shares, credit, and alternatives did well, whereas unlisted property posted a negative return. This reflects the challenges faced by asset classes whose performance is very sensitive to higher interest rates.

This is why having a well-diversified portfolio is important as asset classes perform differently under different circumstances and timeframes.

One-year returns to 30 June 2024 for each asset class Rest invests in. Overseas shares are unhedged. (“Listed” means traded on public markets; “unlisted” means private.)

Sources: Rest, 30 June 2024. Returns are net of investment fees and tax. The earnings applied to members’ accounts may differ. Past performance is not an indicator of future performance. Investment returns are only one factor that you should consider when deciding to invest your super.