What is impact investing?

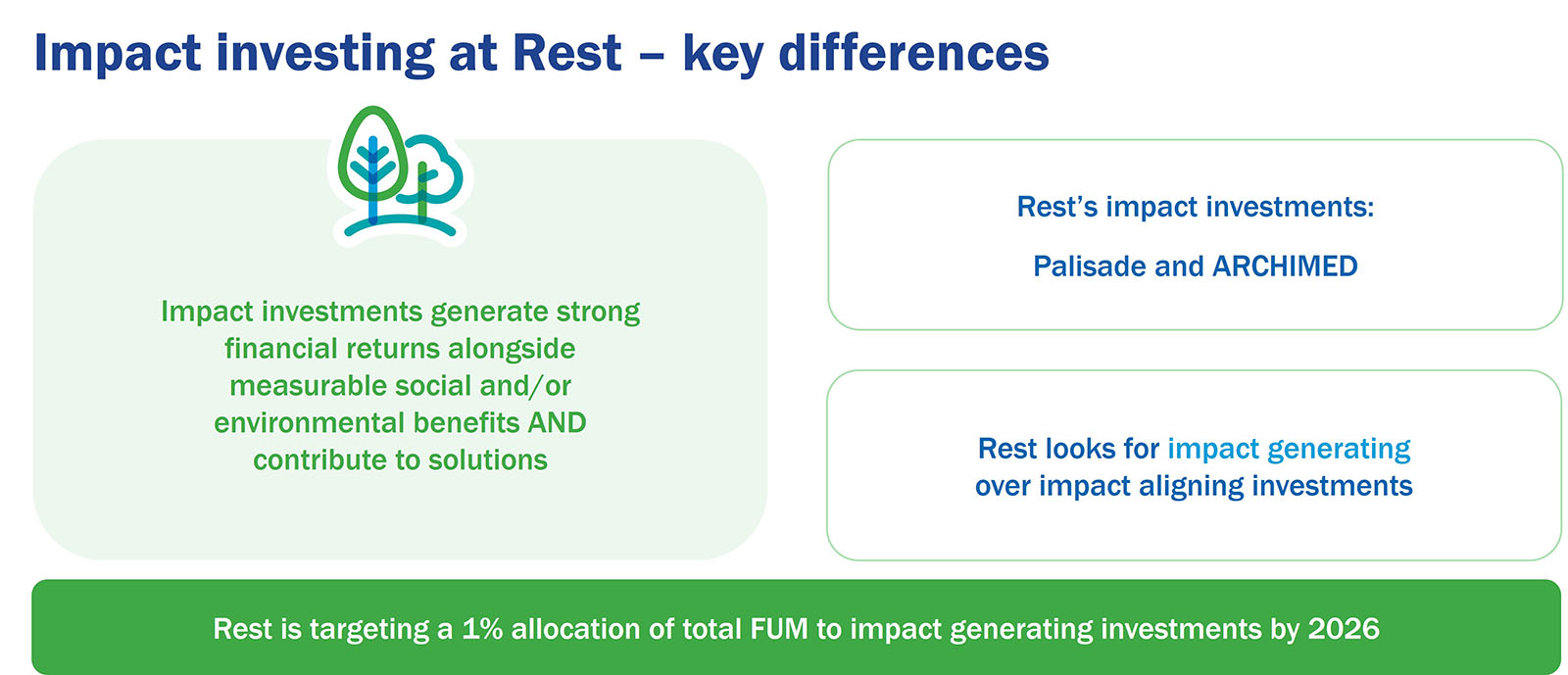

You might have heard about impact investments in the news recently and wondered ‘what are they?’. Impact investments are those made with an intent to deliver measurable social and/or environmental benefits, alongside financial returns.

At Rest, we aim to maximise your personal best retirement outcome by investing in quality assets and focusing on long-term results. It’s important to remember that the financial return of an investment is always the key priority for Rest, and impact investments are no different.

Here’s some more information about some of our impact investments.

Palisade Impact (Infrastructure)

Palisade Impact focuses on investments that target practical solutions to environmental and social challenges by investing in next generation infrastructure assets and businesses that provide essential services.

The nature of infrastructure assets is changing rapidly, with significant disruption through technology developments and decarbonisation. It’s important to have exposure to the next generation of infrastructure assets that have the potential to deliver strong member returns over the longer term.

ARCHIMED (Private equity)

ARCHIMED funds, supports and scales up companies that have a mission to improve health outcomes, specifically companies that create and deliver products and services that aim to improve human and animal health.

ARCHIMED aims to create better, safer and more accessible healthcare across the globe, and promote sustainable and responsible practices.

Why impact investments?

Rest’s investments in Palisade and ARCHIMED aim to help grow your super savings in a responsible and beneficial way. Rest is targeting a 1% allocation to impact investing by 2026.

This is because we believe that responsible investing adds value, but also that not investing responsibly can pose risks for our future economy.