Investment markets had a tough start to this financial year after doing well in FY23. Despite this, our Core Strategy option did relatively well over the quarter with only a small dip in performance (-0.51%) compared to global bonds (-1.88%) and international shares (-2.36%)1. The one-year performance of Core Strategy is still strong at 8.46%. For Pension members, the default Balanced option return was slightly positive for the quarter (0.13%) and is 7.41% over one year.

| Performance | 1 year (%) | 10 years (% p.a.) | 20 years (% p.a.) |

|---|---|---|---|

| Core Strategy (Super) | 8.46 | 6.61 | 7.45 |

| Balanced (Pension) | 7.41 | 6.22 | 7.18 |

Source: Rest, 30 September 2023. Returns are net of investment fees and tax, except Pension which is untaxed. The earnings applied to members’ accounts may differ. Investment returns are at the investment option level and are reflected in the unit prices for those options. Past performance is not an indicator of future performance.

1Global bonds as measured by the Bloomberg Global Treasury Index (AUD hedged) and global shares as measured by the MSCI All Country World Ex-Australia Equities Index with Special Tax (AUD hedged).

What happened? A high-level overview

In our FY2023 investment update, we highlighted certain themes were keeping us on our toes, such as persistent inflation and the likelihood of higher interest rates for longer. Despite this, investment markets were doing well early in the quarter as economic data showed inflation was retreating from high levels, and economic growth still remained robust in the face of high interest rates.

However, market sentiment later turned negative, as data showed central banks still had work to do to get inflation back to acceptable levels. This was particularly the case with oil prices remaining high. At their September meeting, the US Federal Reserve (the US central bank) raised their expectations for interest rate levels through 2024. As a result, markets now anticipate the US will not reduce interest rates until the second half of 2024. The European Central Bank also increased their deposit rate to 4%, their highest level since the Euro was introduced in 1999.

The prospect of higher interest rates for longer led bond and share markets to fall together – a combination that generally only happens during times of high inflation. Share markets were rattled by weaker expectations for economic growth and bonds also struggled as their prices also tend to decline with higher rates.

Outlook

While our Core Strategy has delivered strong returns over the past year, the reasons we were cautious about the market outlook remain, particularly:

- persistently high inflation; and

- the challenging global political and economic backdrop.

We think these issues will continue to cloud the investment outlook and as such we are not taking strong positions in any particular asset classes. Instead, we are aiming to maintain a balanced mix of investments that are well-diversified. We anticipate this will provide some degree of resilience to help offset the volatility we’re currently seeing in share and debt markets, and help deliver strong returns over the long-term. Of course, we are always mindful that market volatility can often provide opportunities to buy attractive investments at discounted prices. We will look to take advantage of such opportunities if they arise, setting the portfolio up well for the long-term.

Investing with Impact

What is impact investing?

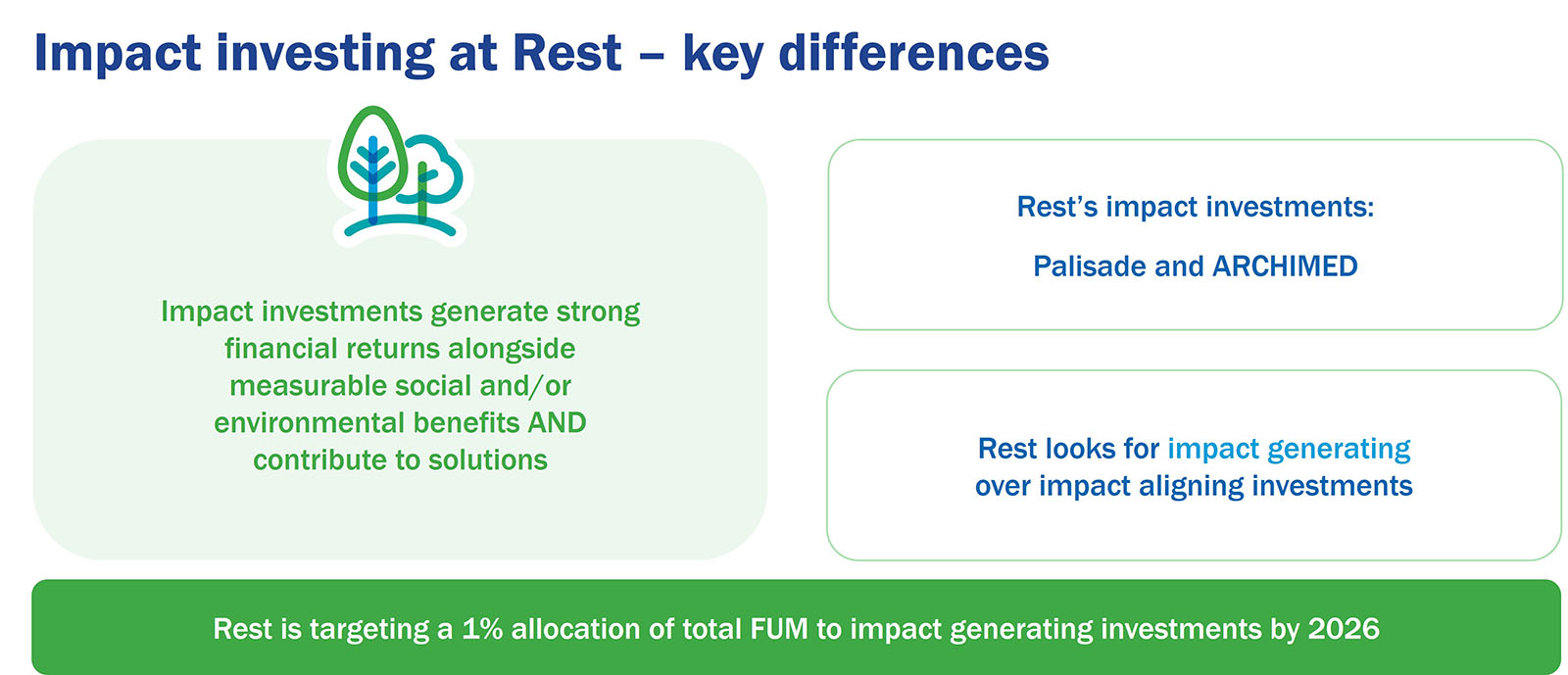

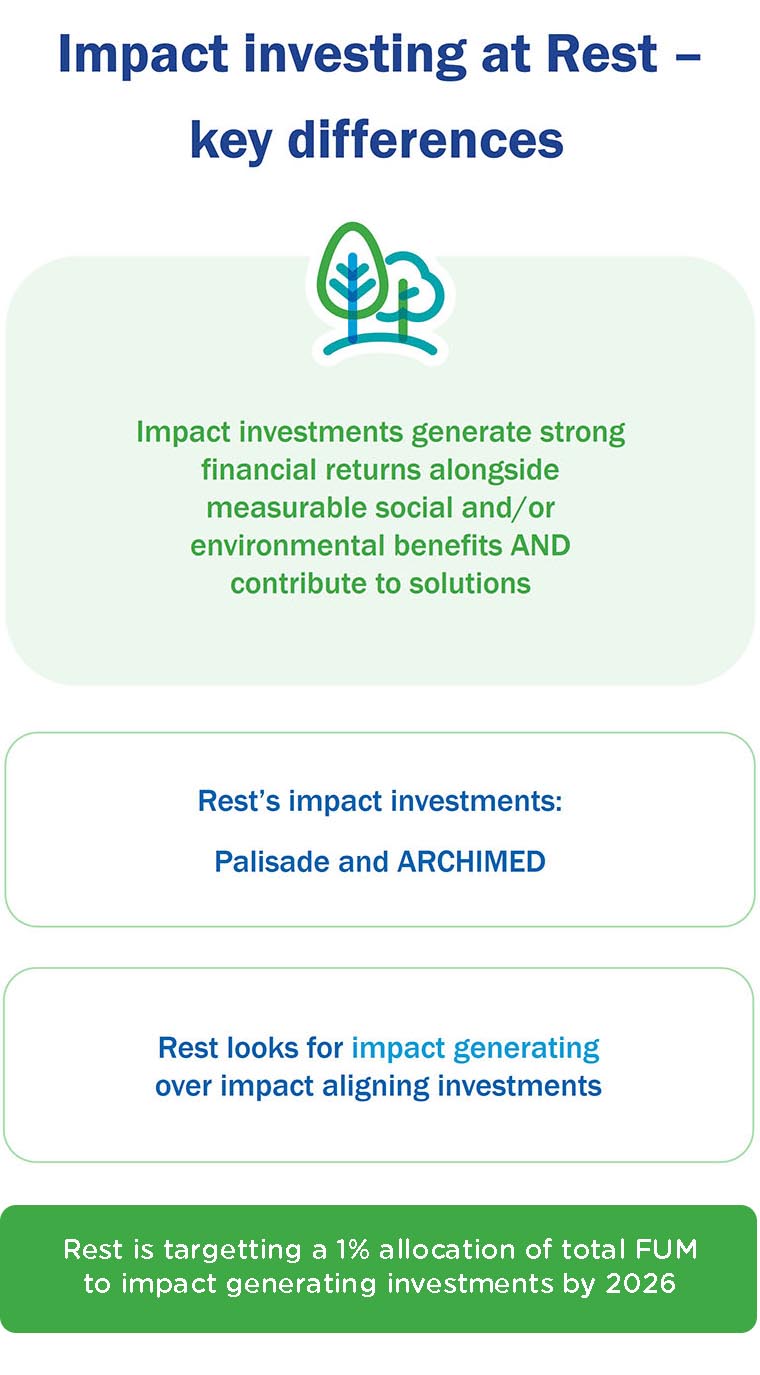

You might have heard about impact investments in the news recently and wondered ‘what are they?’. Impact investments are those made with an intent to deliver measurable social and/or environmental benefits, alongside financial returns.

At Rest, we aim to maximise your personal best retirement outcome by investing in quality assets and focusing on long-term results. It’s important to remember that the financial return of an investment is always the key priority for Rest, and impact investments are no different.

Here’s some more information about some of our impact investments.

Palisade Impact (Infrastructure)

Palisade Impact focuses on investments that target practical solutions to environmental and social challenges by investing in next generation infrastructure assets and businesses that provide essential services.

The nature of infrastructure assets is changing rapidly, with significant disruption through technology developments and decarbonisation. It’s important to have exposure to the next generation of infrastructure assets that have the potential to deliver strong member returns over the longer term.

ARCHIMED (Private equity)

ARCHIMED funds, supports and scales up companies that have a mission to improve health outcomes, specifically companies that create and deliver products and services that aim to improve human and animal health.

ARCHIMED aims to create better, safer and more accessible healthcare across the globe, and promote sustainable and responsible practices.

Why impact investments?

Rest’s investments in Palisade and ARCHIMED aim to help grow your super savings in a responsible and beneficial way. Rest is targeting a 1% allocation to impact investing by 2026.

This is because we believe that responsible investing adds value, but also that not investing responsibly can pose risks for our future economy.