It’s been a year of ups and downs in investment markets. A difficult second half of the year led to a weaker outcome for many super funds this financial year.

At Rest, our MySuper option, the Core Strategy, has weathered the storm relatively well, returning -2.37% to June 30, outperforming most major global share markets1. The average return for super funds this year was -3.44%2. A quarter of these funds lost more than 4.34%. Some markets contributing strong gains in the first half of the year gave them all back in the second half, and more. US shares rose over 11% in the six months to end Dec 2021; they fell nearly 20% in the next six months3.

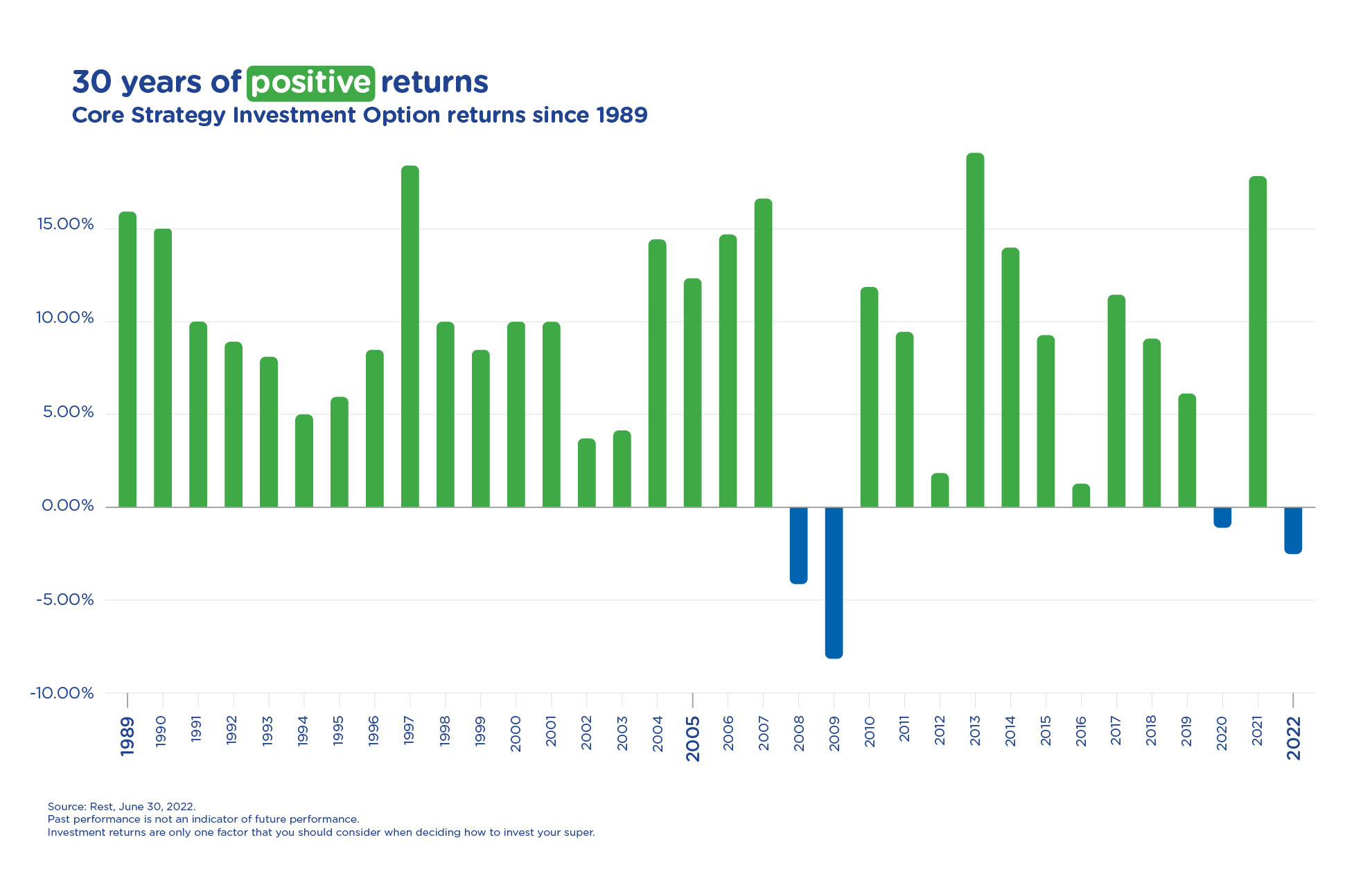

In our 34-year history, the Core Strategy has delivered 30 years of positive returns. While this is only the 4th time this investment option ended the financial year with a negative return, it follows the Core Strategy’s return of 17.43% in the previous financial year. The 10 year annualised return for the Core Strategy is 8.06%1.

Chief Investment Officer, Andrew Lill

As Andrew Lill explains: “It’s normal for markets to move up and down over time. Our team of experienced investment professionals continue to manage the portfolio to account for these challenging times, and our focus remains on helping you grow your super over the long term.”

How Rest responded to inflationary concerns

Despite investment market buoyancy over the first half of the 2022 financial year, there were warning signs this may not last. As the impacts of living with Covid reshaped consumer activity, supply chains around the world came under pressure. Fears over rising oil, gas and commodity prices fuelling inflation also sparked market volatility and the foundation was laid for rising prices of goods and inflation - US inflation hit 6.8% by late November. The Russia and Ukraine conflict then exacerbated concerns over food and energy prices and the path was laid for global interest rate rises.

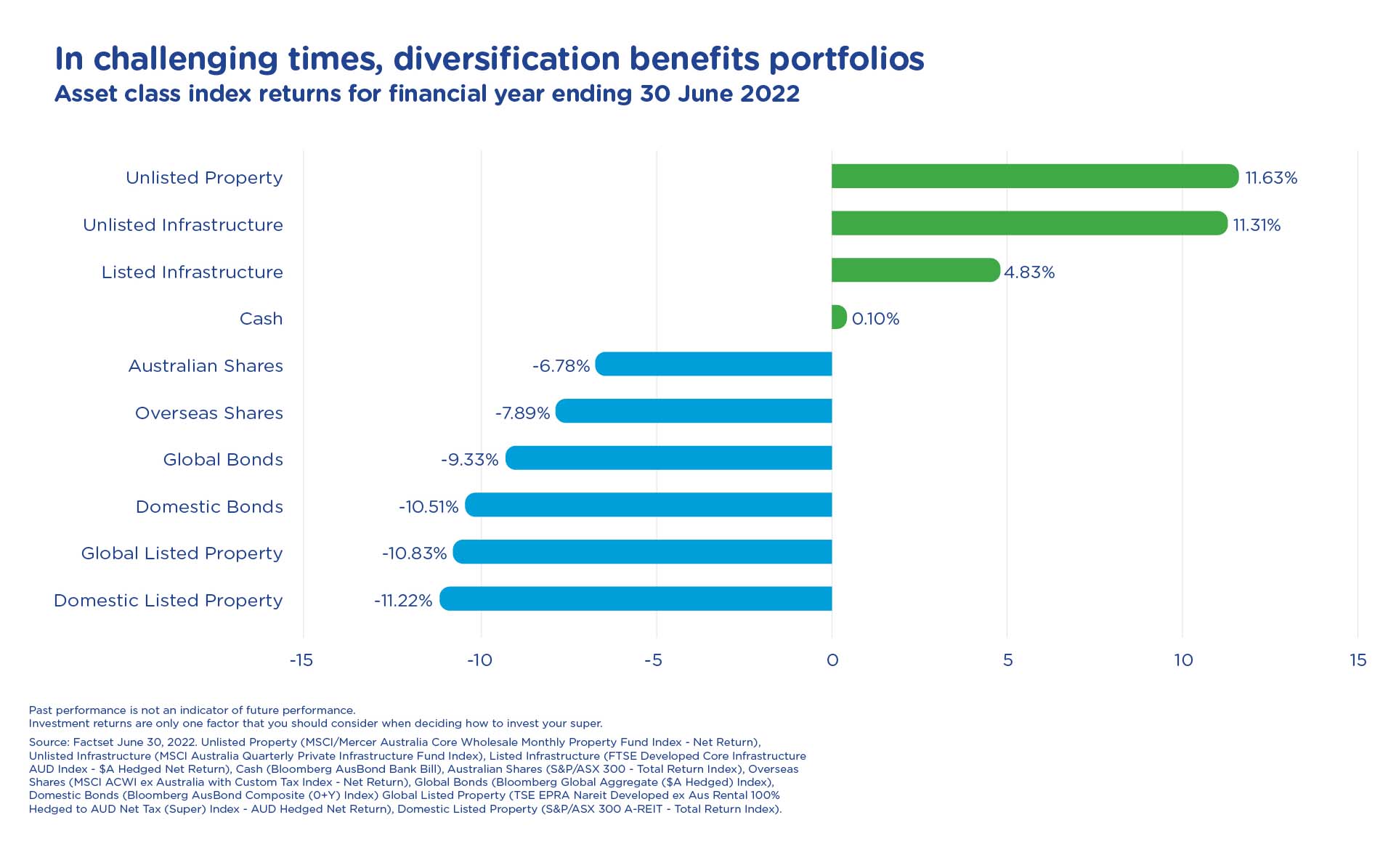

Rest was increasingly cautious of this inflation risk. By September last year we established a new allocation to listed infrastructure. This, alongside strong returns from our established property, infrastructure and agriculture assets helped cushion total returns from the full impact of market downturns.

As central banks responded to inflationary concerns with frequent and significant interest rate rises (relative to recent history) we also witnessed the unusual response of bond and equity markets falling together. With active management of investment risks on the expectation of challenging markets we had started positioning the portfolio generally more defensively in January. We reduced overall equity exposure and the overall credit exposure. We also started increasing cash in the portfolio, allowing us to maintain some flexibility to take advantage of weaker markets if we saw opportunities for long-term benefits with lower priced assets. Positioning our debt allocation to be less sensitive to interest rates rises through this period also helped outcomes on a relative return basis.

Why diversification matters?

It's times like these when the benefits of true diversification are seen. Some of the more traditional investments such as listed equities and bonds were among the poorer performers for the financial year on an absolute return basis. By diversifying allocations beyond these to include other types of investments that perform differently over time, for example real assets, such as actual property and infrastructure assets, aggregate returns can be smoothed.

Rest’s Core Strategy option invests in a range of asset classes and while near-term market volatility created challenges for all super funds and listed equities, bonds and fixed income returns were weaker, we undertook initiatives to increase our exposure to unlisted real assets - such as infrastructure, commercial property and agriculture - to provide stability to our investment portfolio with a view to generating strong long-term net returns for our members. One such unlisted real asset investment was Quay Quarter Tower (QQT) in Sydney which completed in April 2022 with Rest finalising the acquisition of a one-third stake on completion.

The new tower features around 89,000 square metres of office space, 95 per cent of which is already leased, and around 4,000 square meters of retail space. The building also has a 5.5 Star NABERS Energy Rating, and a 6 Star Green Star Design & As Built rating from the Green Building Council of Australia.

“This landmark property is expected to generate strong long-term net returns for our members. With nearly all the office space leased under long-term arrangements, it offers a secure income stream,” said Simon Esposito, Deputy Chief Investment Officer, Rest.

QQT: rotating forms and a unique façade maximise natural light and harbour views

Comprising innovative and sustainability-focussed adaptive reuse, around 68 per cent of the original tower’s core structure was retained, including 95 per cent of the internal structural walls, while also doubling the leasable space.

“By upcycling much of the original structure and reusing materials, more than 8,000 tonnes of embodied carbon were saved during construction. That’s the equivalent of 35,000 airline flights from Sydney to Melbourne,” said Leilani Weier, Head of Responsible Investment & Sustainability, Rest.

As part of our roadmap to achieving a net zero carbon footprint for the fund by 2050, Rest aims to have our directly owned property assets achieve net zero carbon emissions in operation by 2030 in accordance with the WorldGBC's Net Zero Carbon Buildings Commitment.

Where to from here?

We currently expect to remain in a lower growth and higher inflation environment throughout the remainder of the calendar year.

We have confidence that many of our more inflation-resilient investments, like infrastructure, private equity, property and agriculture, will continue to serve our members well. Rest’s investments in these asset classes can provide important stability to an investment portfolio, especially in challenging times where share markets are volatile and fixed income returns are weaker.

From an investment perspective, the conditions may also be becoming more positive for those seeking to invest for the longer term such as your younger employees. Super funds may be able to acquire investments at cheaper prices, which has the potential to benefit members with higher returns in the future. Rest is grateful for your continued support and the ongoing privilege of looking after the retirement savings of your employees. By actively managing our investments, staying diversified and continuing to extend our investment capabilities, we are confident Rest will maintain and improve competitive returns for your employees.

Stay informed!

Watch Rest’s annual End of Financial Year on-demand Webinar to hear from our Chief Investment Officer, Andrew Lill, on our performance over the FY21/22 financial year and how we aim to deliver resilience in challenging markets.

1. Source: Rest, June 30, 2022. Returns are net of investment fees and tax, except Pension which is untaxed. The earnings applie.s for those options. Returns for the ten-year period are annualised returns.

2. As measured by the SuperRatings-SR50 Balanced (60-76) Index

3. As measured by the S&P500

Past performance is not an indicator of future performance. Rest's other investment options may have performed differently. For information on other investment options, please visit https://rest.com.au/investments/options

Each investment option has a different balance of asset classes and weightings. For details on each investment option, please visit https://rest.com.au/investments/options