If you’ve been employed for a while it’s easy to overlook the humble payslip. And if you’re new to work or change jobs, it might seem a bit unfamiliar. But if you know what to look for, your payslip can help make sure you’re getting what you’ve worked hard for, so you can stay in control of your financial plans now and into the future.

What’s a pay slip and why should I check it?

Every time you get paid, your employer is legally required to give you a payslip. It’s a written record showing things like your earnings, taxes, entitlements and super contributions for a specific pay period. It can be on paper or in electronic form (like email or an app that your company uses, for example), and by law you must get it within one working day of your pay day.

It's important to check your pay slips to make sure you're paid the right amount and getting the right entitlements, like super.

What should my pay slip include?

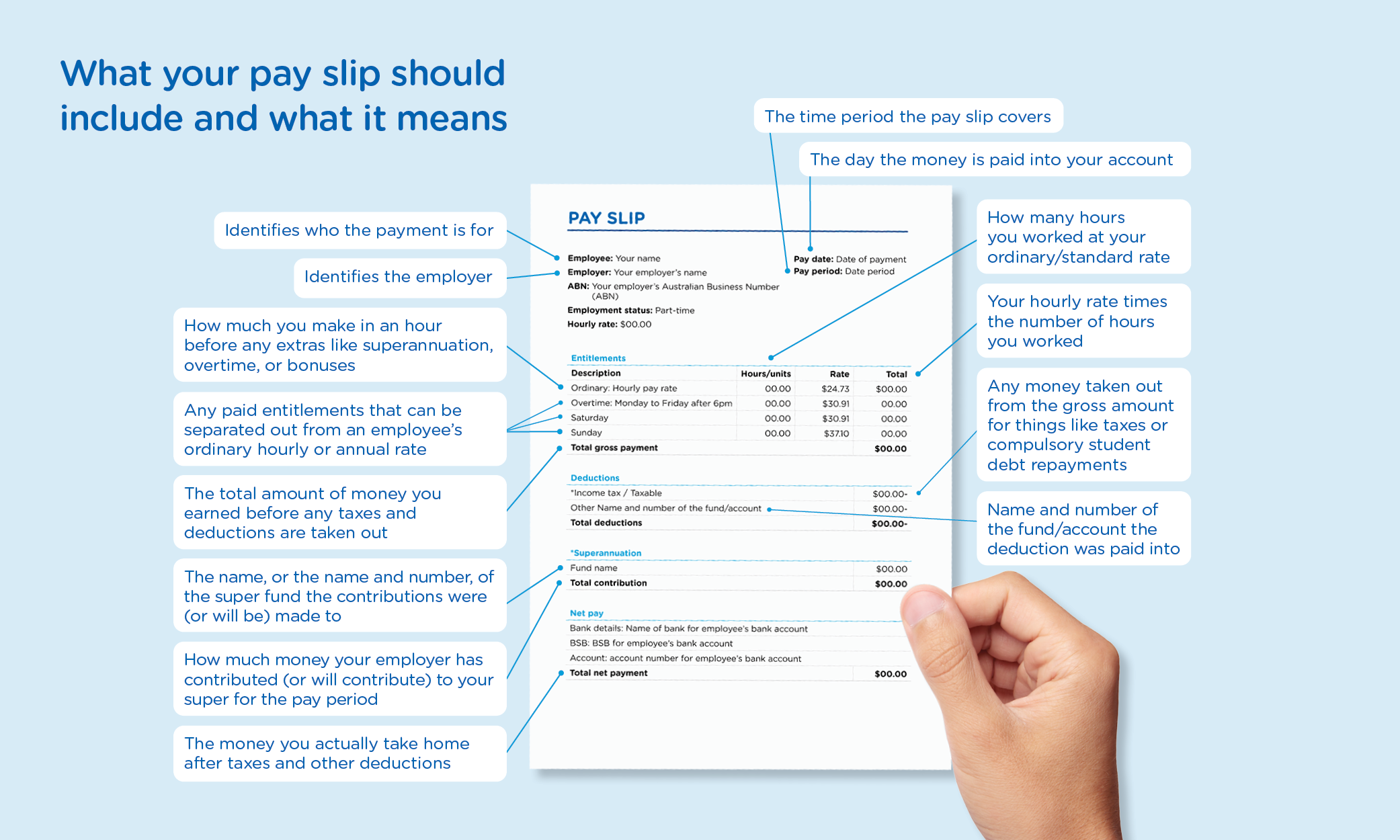

Your pay slips can look different depending on where you work, but they should always contain certain details. .We break down what’s required in a pay slip, according to the Fair Work Ombudsman (FWO), in the table below. Grab your latest pay slip and compare it against the requirements.

| What your pay slip should include | What it means |

|---|---|

| Your name | Identifies who the payment is for |

| Your employer's name and Australian Business Number (ABN), if applicable | Identifies the employer |

| Pay period | The specific days you're getting paid for |

| Date of payment | The day the money is paid into your account |

| Gross pay | The total amount of money you earned before any taxes and deductions are taken out |

| Net pay | The money you actually take home after taxes and other deductions |

| Any loadings, allowances, bonuses, incentive-based payments, penalty rates or other separately identifiable entitlement | Any paid entitlements that can be separated out from an employee’s ordinary hourly or annual rate |

| If you’re paid an hourly rate | |

| Ordinary hourly rate | How much you make in an hour before any extras like superannuation, overtime or bonuses |

| Number of hours worked at that rate | How many hours you worked at your standard rate |

| Total dollar amount of pay at that rate | Your hourly rate times the number of hours you worked |

| If you’re paid an annual rate of pay (salary) | |

| The rate as at the last day in the pay period | Your annual salary excluding any extras like superannuation or bonuses |

| If this is your last pay slip | |

| The pay rate that applied on the last day of employment | What your last pay rate was when you left your job |

| Deductions | |

| Amount and details of each deduction | Any money taken out from the gross amount for things like taxes or compulsory student debt repayments |

| Details of where the deduction went | Name and number of the fund/account the deduction was paid into |

| If you’re entitled to the super guarantee from your employer | |

| Amount of super contributions | How much money your employer has contributed (or will contribute) to your super for the pay period |

| Details of super fund | The name, or the name and number, of the super fund the contributions were (or will be) made to |

Tip: Cross-check your pay slip with your super account

While the right amount of super may be listed on your payslip, it doesn’t always mean that the money has been contributed to your super fund by your employer.

To see when and how much super your employer has contributed, you can check your super fund’s app or member portal, or review your annual statements. It should show you all the employer contributions that your employer has paid.

Rest members can jump on the Rest App or MemberAccess and see their super balance and employer contributions whenever they want.

Keep in mind that employers are only required to pay super contributions quarterly, so while you should be cross-checking regularly, it doesn’t necessarily have to be on pay day.

What if my employer isn’t giving me pay slips or it’s wrong?

All Australian employers are legally required to give you pay slips on time, with the right information, even if you’re paid in cash.

If something’s not right, here’s some steps you could take.

Firstly, ask your employer (often the HR person or Pay Officer, for example) to give you your pay slips or send you pay slips with the correct information.

If you're nervous about this conversation, it can help to prepare for it (see the FWO website for some helpful resources). You may also want to take notes in the meeting. And remember, you’re legally entitled to receive your pay slips.

Follow up with your employer and send them information about pay slips to remind them of their obligations.

It's important to give them time to fix the issue. The FWO recommends giving your employer seven days to gather any missing pay slips or check their records to provide pay slips with the correct information.

If you’ve given your employer the chance to make things right and the issue still isn’t sorted after waiting seven days, it could be time to reach out to the FWO. Fair Work Inspectors can fine employers found to be doing the wrong thing. They may also be penalised if the FWO chooses to take them to court.

Tip: Keep a record

Keep a record of the hours you worked. You can jot them down in a diary or use an app to track them. This could help if there's ever a dispute about your pay.

For more information, visit the FWO website.

Product issued by Retail Employees Superannuation Pty Limited. Before deciding to join or stay, consider the PDS and TMD available at rest.com.au/pds and whether it is appropriate for you.