Why LBCT?

We look for infrastructure assets like LBCT that we believe have a long lifespan and revenues supported by long-term contracts and therefore have the potential to enjoy strong returns over the long term. The performance of infrastructure assets has the potential to deliver returns that are independent of the performance of more traditional asset classes, like shares and bonds, that tend to be more affected by inflation or other market factors. (Check out our article on infrastructure investments to learn more, including investment risks).

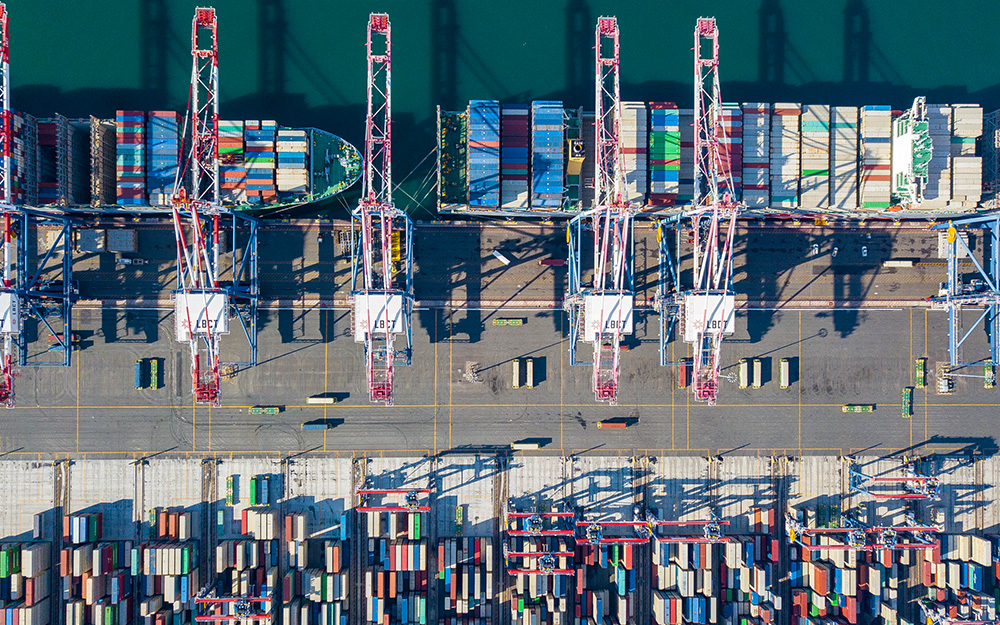

LBCT is an infrastructure asset with a focus on sustainability and efficiency.

In 2021, it completed a huge modernisation project, known as the Middle Harbor Redevelopment project, that upgraded berths to accommodate the largest cargo ships and introduced advanced cargo-handling technologies 3.

Through the use of electric infrastructure, vehicles and equipment, LBCT is aiming to become a net-zero emissions marine terminal by 2030. The conversion of cranes and cargo handling vehicles to zero-emissions electric has reduced greenhouse gas and other pollutant emissions by 86% and has quadrupled its cargo-handling capacity 4. Further, both the ports of Long Beach and Los Angeles have adopted a Clean Air Action Plan (CAAP), and LBCT seeks to be the first marine terminal to meet all CAAP goals by 2030.

LBCT was even awarded the Sustainable Innovation Project of the year by the US Green Building Council-Los Angeles in December 2023!

We think LBCT’s focus on sustainability and efficiency makes LBCT attractive to shippers, a good corporate citizen in its own neighbourhood, and a long-term infrastructure investment that will help deliver strong returns.

1. America’s Top 20 Container Ports in 2024 - courtesy of Descartes Datamyne | SupplyChain247

2.Port of Long Beach - Facts at a Glance | Port of Long Beach (polb.com) 3.The Making of a State-of-the-Art Terminal | Port of Long Beach (polb.com)

4.Long Beach Container Terminal wins sustainable innovation award | Marine Log %