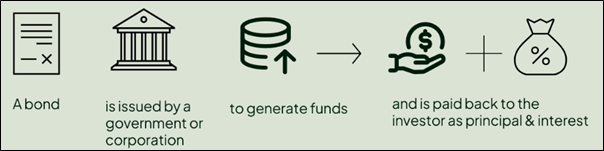

What are bonds?

What are different types of bonds?

Did you know, though, that there are many different kinds of bonds? Let’s take a look at some of the most common types below.

General

How your Super investments work

Expand your knowledge and learn about how your Super is invested.

General

Risk and return in your super investments

Investments involve risk including super. Learn about risks to consider before investing your super.