Selecting investment options

Scroll

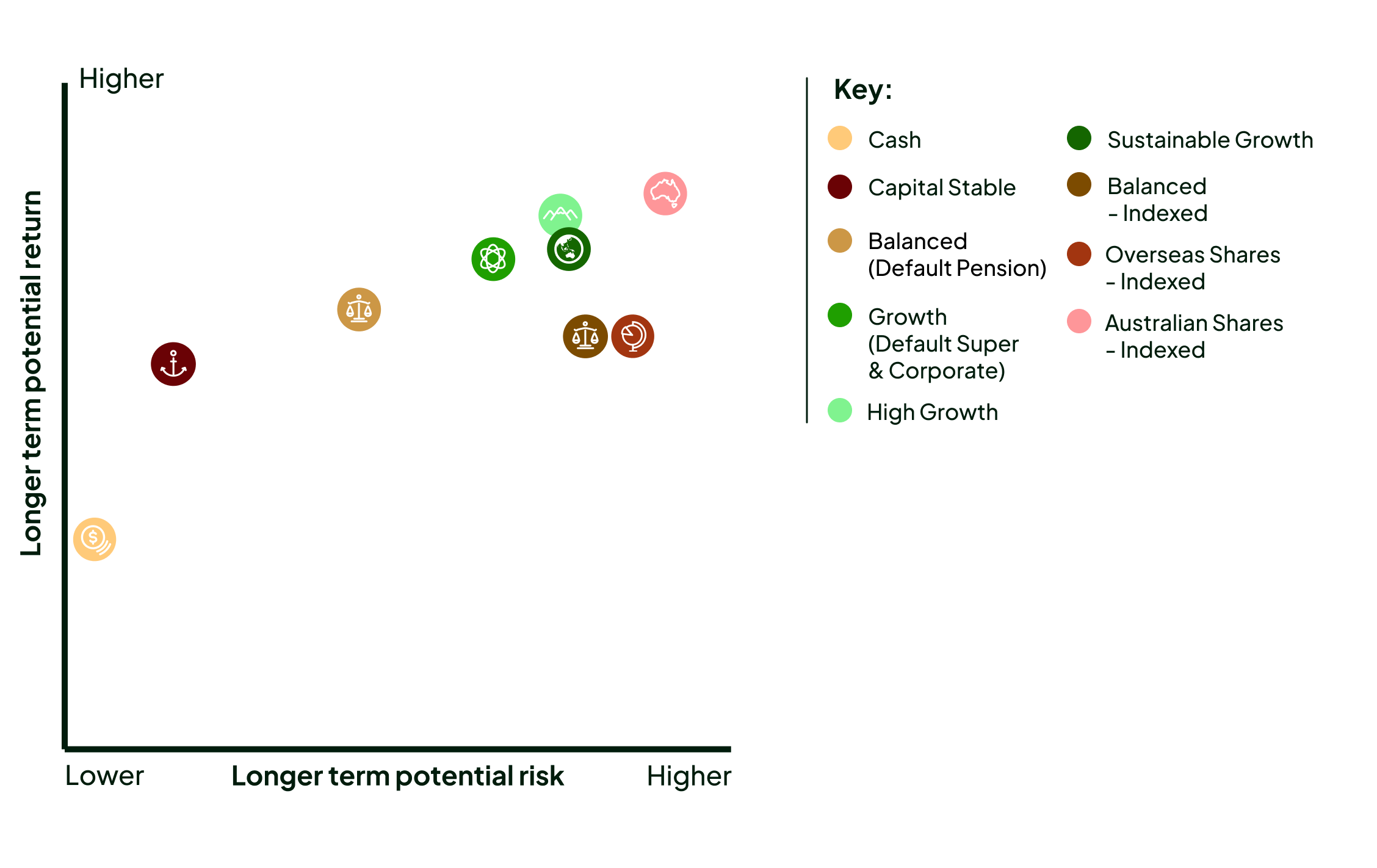

Rest Super and Rest Corporate accounts

Your default investment option is Growth

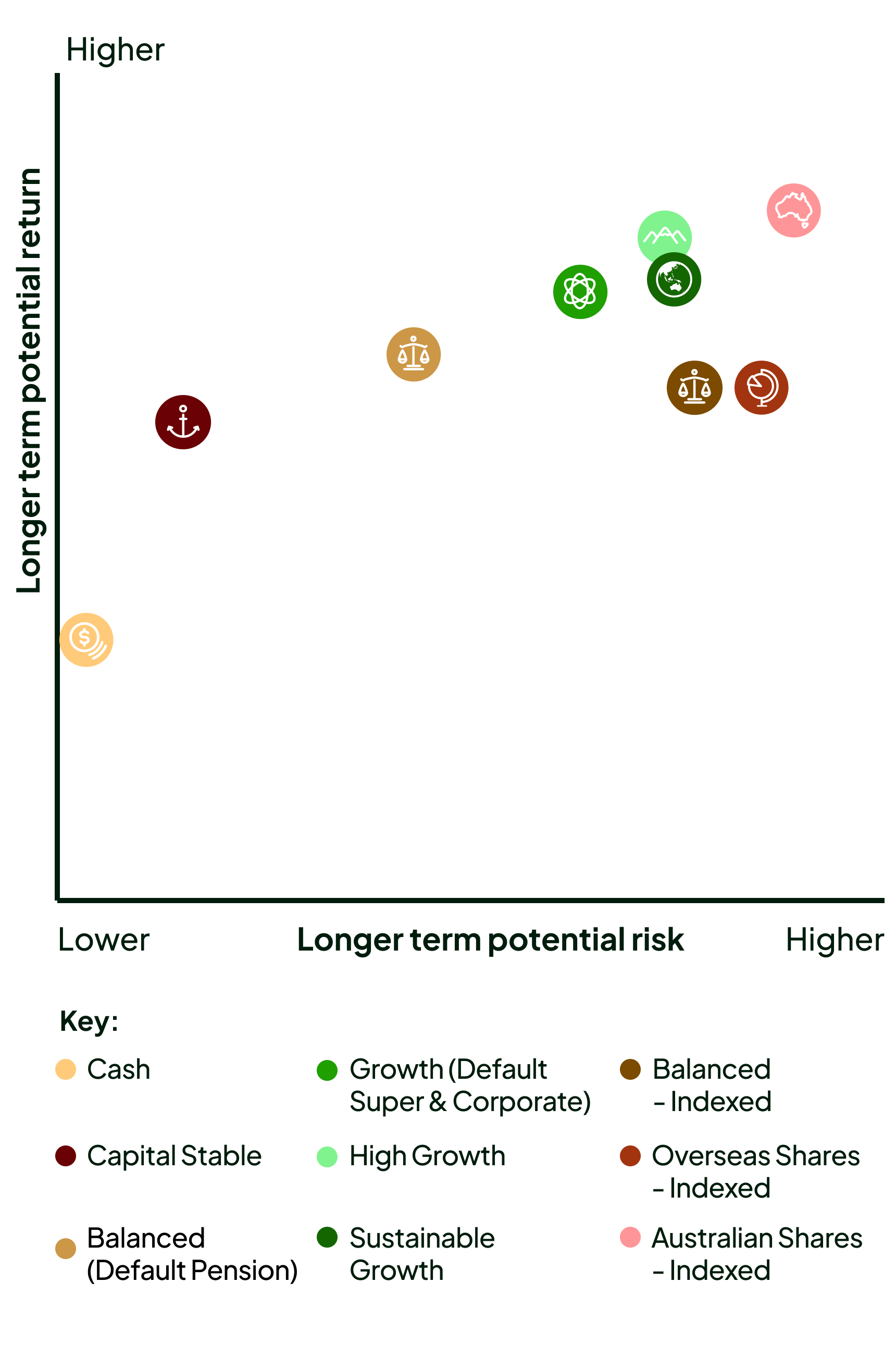

Rest Pension accounts

Your default investment option is Balanced