Cash

Cash returned 0.50% for super and 0.57% for pension, both outperforming the RBA Cash rate over the financial year and benefitting from rising interest rates.

Bonds

Over the financial year, the Bonds option returned -8.09% for super and -8.99% for pension. Over the option’s 2 year investment timeframe, both super and pension have outperformed the -4.97% investment return objective by 0.96% (super) and 0.55% (pension).

This financial year has not been a good year for bond markets as a result of inflation worries and rising interest rates. Although inflation and interest rate rises were expected, the pace of the rate rises was quicker than forecast and therefore created a period where bonds prices fell more than anticipated. As such, the price of existing bonds fell in the short-term providing a negative return. Given the rising rate environment, we have selected bonds that are less sensitive to interest rate rises, which has helped deliver returns above the option’s objective return.

Property

The Property option returned 15.96% for super and 17.18% for pension over the financial year. Both options strongly outperformed the benchmark of 5.11%; super by 10.85% and pension by 12.06%.

Over the longer term, with an investment timeframe of 7 years, both the super and pension options have comfortably outperformed against their investment return objective of 5.04%, returning 9.63% (super) and 10.50% (pension) over the same period.

Direct property has been a very strong performer over the last financial year, with rising property prices supported by strong employment data, rising wages, a shortage of high quality property and historically low interest rates.

Rest’s high quality Australian office portfolio has outperformed the wider market with a flight to quality buildings for tenants after Covid which has led to prime office space experiencing strong investor demand. Additionally, strong tenant demand for Rest’s US Industrial and Multi-family investments has led to outsized rental growth in these sectors.

Shares

Shares returned -5.78% for super and -6.59% for pension, both outperforming the benchmark return of -6.83% over the financial year. Over the investment return objective timeframe of three years, both super and pension have slightly underperformed the benchmark, returning -1.19% for super and -0.44% for pension.

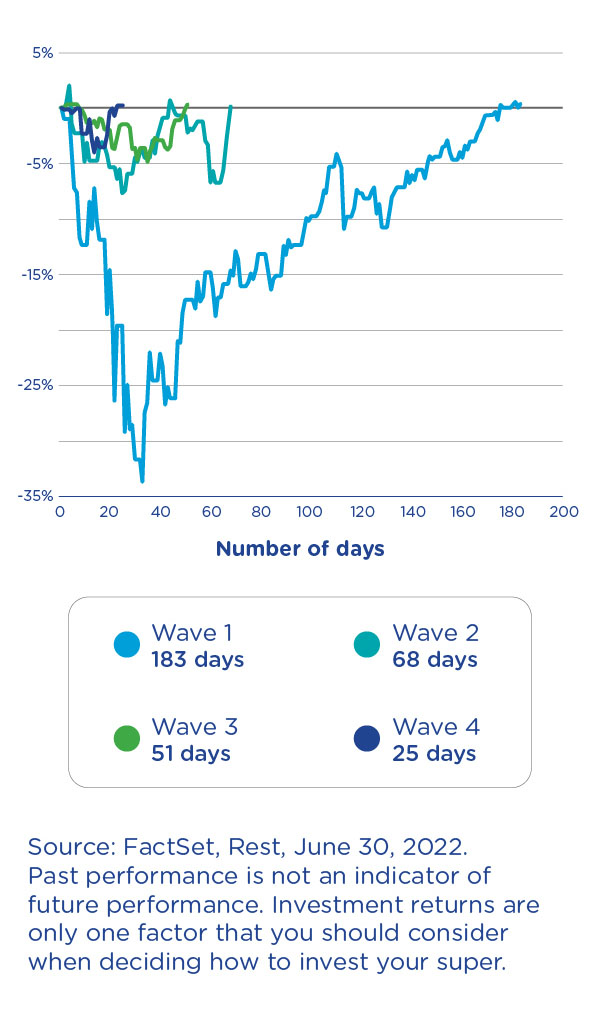

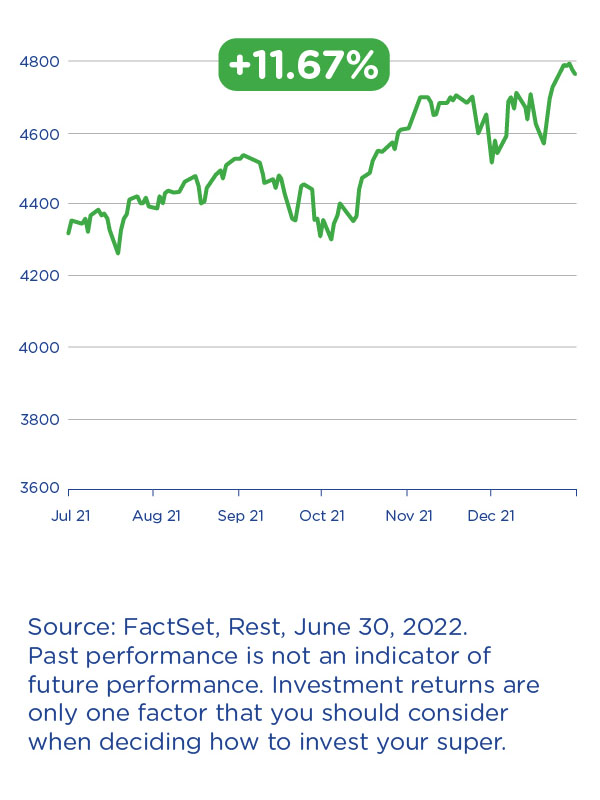

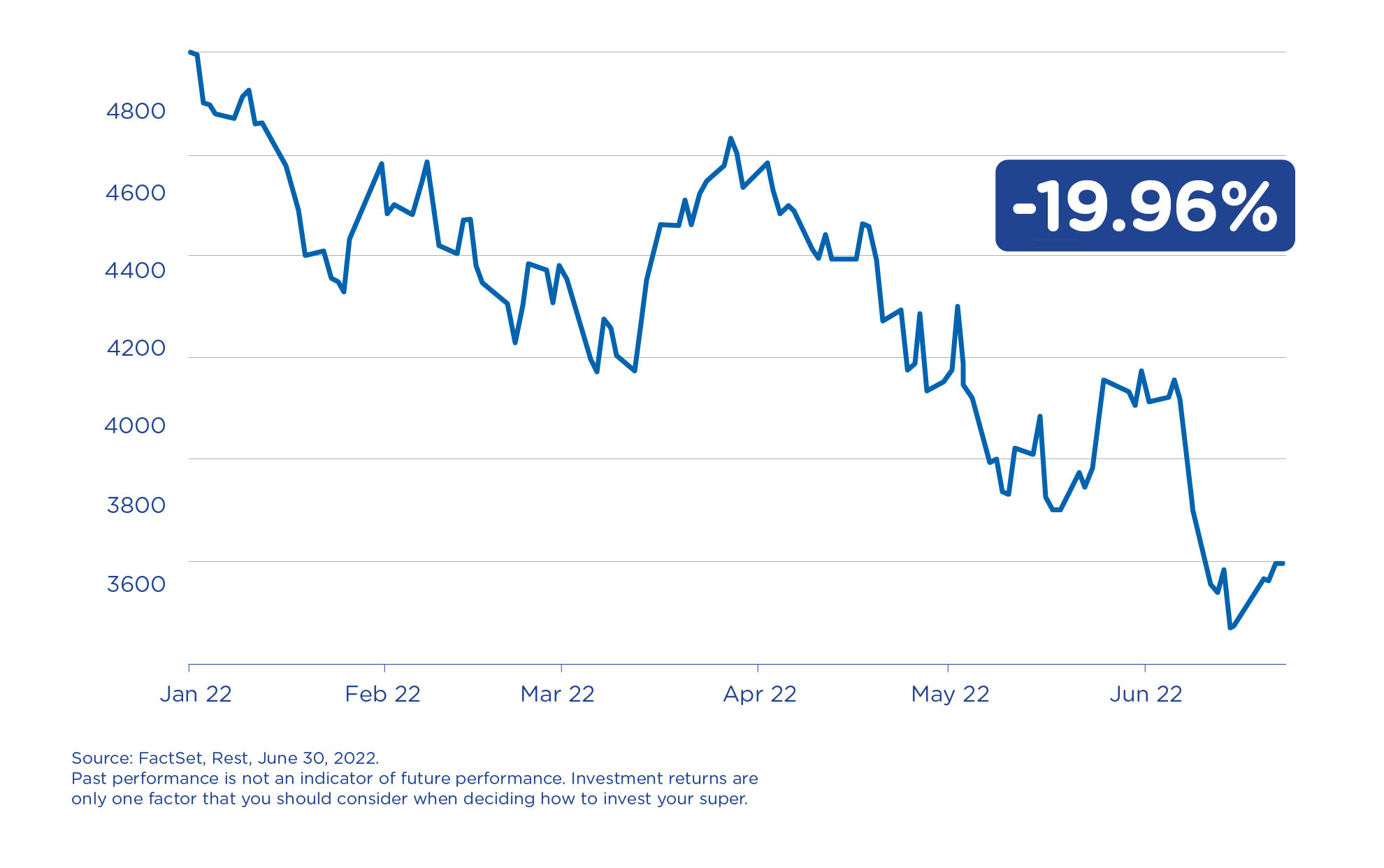

This option invests in both Australian and overseas shares. Both overseas and local share markets fell significantly during the second half of the 2022 financial year after rapid rises in inflation led to faster than expected interest rate rises, and eroded the strong performance of shares in the first half of the year. Despite this, our investments in Australian shares strongly outperformed the index, driven by our exposure to companies that benefitted from the energy transition theme and also companies that improved their business performance which helped to mitigate the overall negative performance.

Ultra large companies led the strong growth in the US and other overseas markets, and the portfolio underperformed given our investment in companies of all sizes to diversify the portfolio. While the portfolio made up ground in the second half of the year as the large companies fell in value, overseas markets fell across the board as a result of rising interest rates. In the US markets, our lower weighting to large technology shares in the strong period to December was a key driver of underperformance, whilst our low weighting to shares in China and our stock selection in the Communications sector helped performance.

Australian Shares

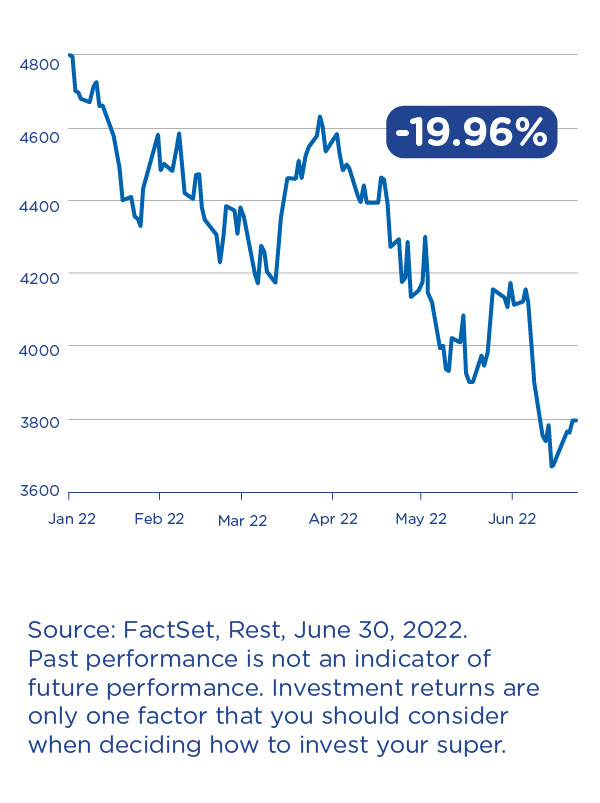

The Australian Shares option returned -3.54% for super and -3.82% for pension, both easily outperforming the S&P/ASX300 index which delivered -6.78% over the financial year.

Over the option’s 3 year investment timeframe, both super and pension have outperformed the 3.44% investment return objective by 0.75% (super) and 2.15% (pension).

Australian share markets fell significantly during the second half of the 2022 financial year after rapid rises in inflation led to faster than expected interest rate rises, eroding the strong performance of shares in the first half of the year. Our outperformance against the index was driven by our exposure to companies that benefitted from the energy transition theme such as Lynas and Jervois and also companies that improved their businesses, like Tabcorp and QBE Insurance.

Australian Shares – Index

Australian shares – Index returned -5.62% for super and -6.43% for pension, as Australian shares retreated over the financial year. Australian share markets fell significantly during the second half of 2022 after rapid rises in inflation led to faster than expected interest rate rises, eroding the strong performance of shares in the previous half of the financial year.

Because the option is designed to track the returns of the underlying Australian shares index (ASX300), returns should be expected to go up when the index returns go up, but also expected to track them when they go down.

Overseas Shares

Overseas Shares returned -8.59% for super and -9.53% for pension, both slightly underperforming against the benchmark of -7.66%. Over the three year investment timeframe, both super and pension have underperformed the global shares index.

Overseas shares fell significantly during the second half of the 2022 financial year after rapid rises in inflation led to faster than expected interest rate rises, eroding the strong performance of shares in the first half of the year. It was a challenging period for active management with markets driven by policy events like interest rate changes. The war in Ukraine intensified the global energy crisis and led to an unusual mix of traditionally defensive and traditionally growth shares (like those in energy and commodities) outperforming at the same time.

Ultra large companies led the strong growth in the US and other overseas markets, and the portfolio underperformed given our investment in companies of all sizes to diversify the portfolio. While the portfolio made up ground in the second half of the year as the large companies fell in value, overseas markets fell across the board as a result of rising interest rates. In the US markets, our lower weighting to large technology shares in the strong period to Dec was a key driver of underperformance, whilst our low weighting to shares in China and our stock selection in Communications helped performance.

Overseas Shares – Index

The Overseas Shares option returned -5.99% for super and -5.94% for pension, as overseas shares retreated over the financial year.

The option is designed to track the returns of the underlying global shares index so returns should be expected to go up when the index return goes up, but also expected to track them when they go down. Overseas shares fell significantly during the second half of the 2022 financial year after rapid rises in inflation led to faster than expected interest rate rises, and eroded the strong performance of shares in the first half of the year.