Investment Updates

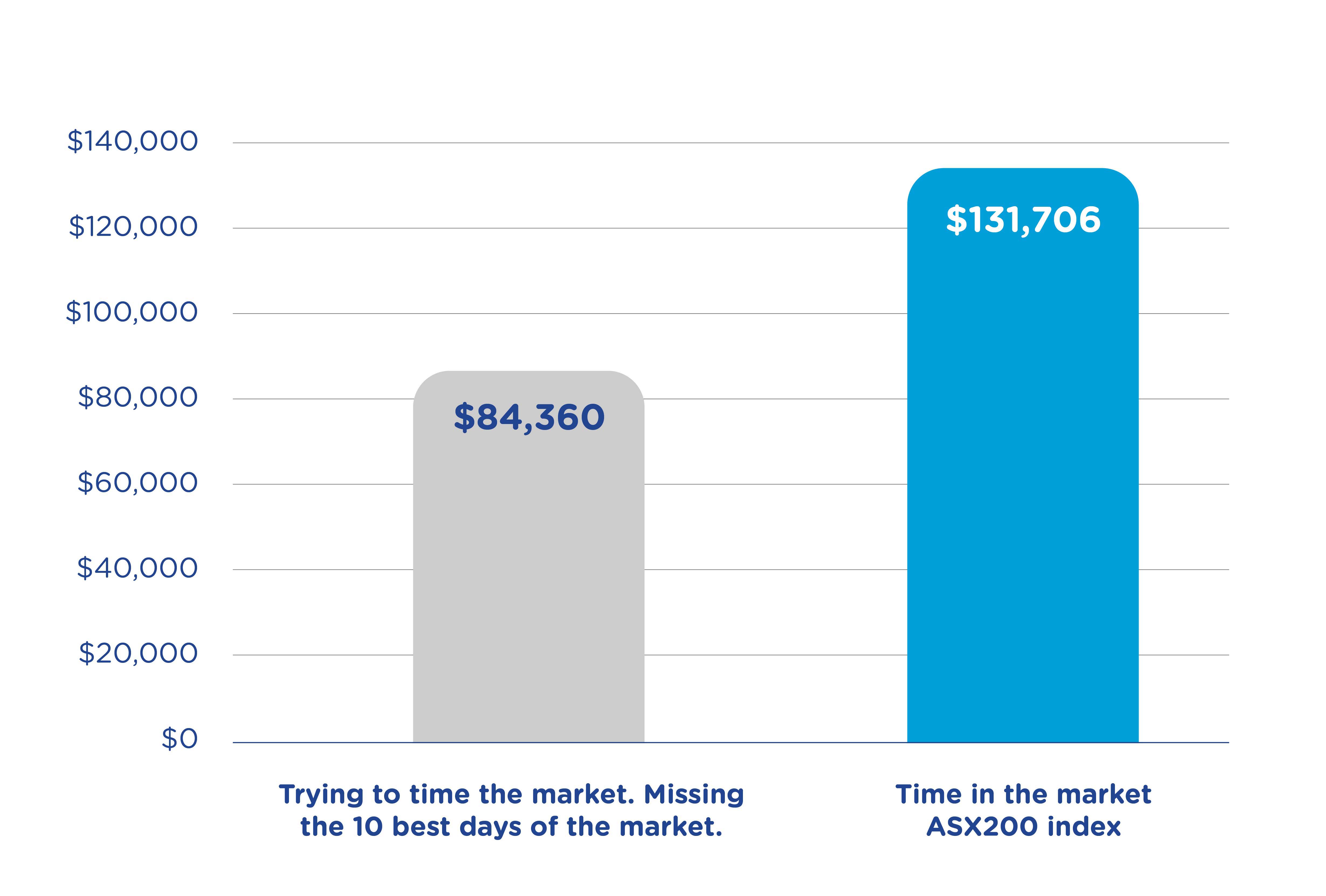

Diversification and why it matters to super

The recent turmoil in financial markets offers a timely reminder of the benefits of diversification.

Investment Updates

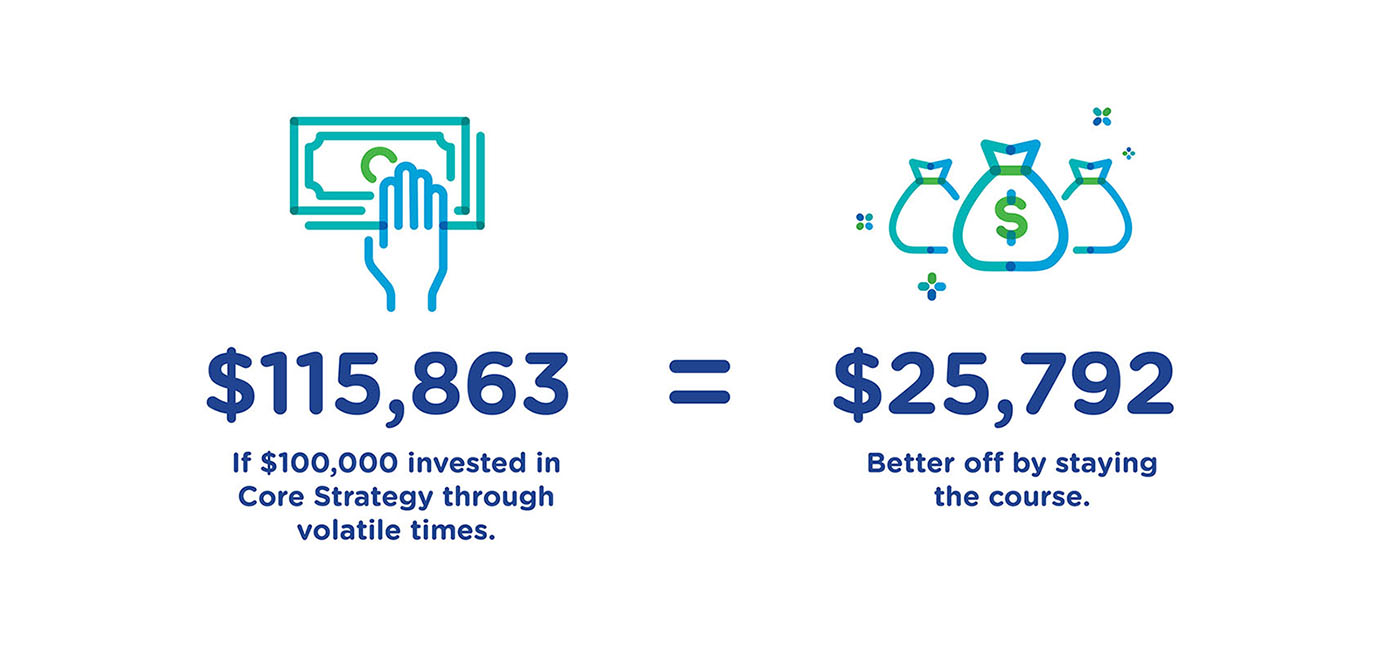

Why does my super balance go up and down?

Investment markets can go up or down depending on what’s happening in the world.

Investment Updates

Inflation and how it impacts your super

Inflation has raised the cost of living. Let’s have a look at the causes and how it can affect super.