Looking back at the markets…

Share markets led returns upwards despite cost of living pressures

Employment remained high, and pockets of ongoing spending from COVID-19-savings generally supported economic growth. In addition, positive company earnings continued to support share market gains.

Countering this was a backdrop of elevated inflation and interest rate hikes. Markets also had to navigate:

- the prolonged Russia-Ukraine war adding to inflationary pressures and gas shortages;

- the UK government fiscal plans causing bond markets and non-US Dollar currencies to plummet; and

- the collapses of Silicon Valley Bank and Credit Suisse with fears of a wider banking meltdown.

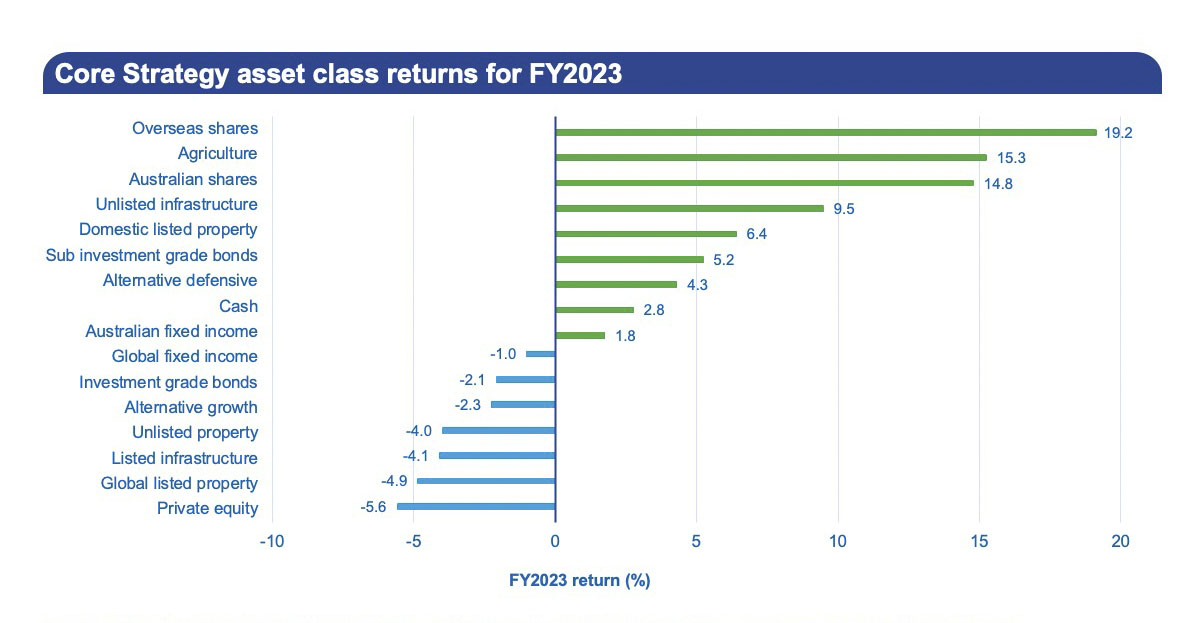

Following twelve rate rises in Australia, the effect of stubbornly high inflation on markets has been varied. Looking at the graph below, we can see that the positive performers are asset classes that have navigated higher interest rates and strong growth. Generally, the weaker performers are those that are more exposed to rising rates and higher inflation.

Source: Rest, 30 June 2023. Past performance is not an indicator of future performance. Investment returns are only one factor that you should consider when deciding to invest your super.

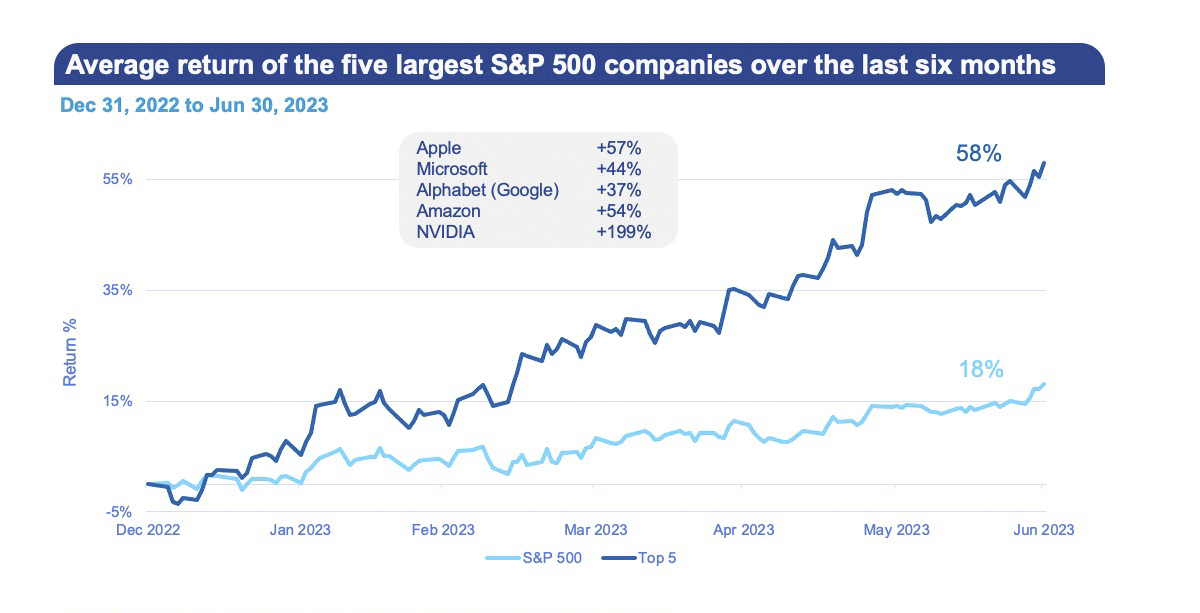

Even within the asset classes, we also saw a range of returns. US “mega-tech” stocks drove market performance (S&P500) over the final six months, benefitting Rest’s portfolios holding overseas shares, as excitement and optimism grew around the potential for artificial intelligence (AI). Australian shares also performed well over the year, driven by demand for resources.

The strong performance of the US market, the S&P500, has been extremely concentrated amongst a handful of star performers, with the top 5 stocks (dark blue line) driving most of the returns as shown in the graph below. Apple became the first stock in history to reach a value of US$3 trillion, whilst a handful of similar stocks have doubled or tripled in price since January.

Source: Rest, 30 June 2023. Past performance is not an indicator of future performance. Investment returns are only one factor that you should consider when deciding to invest your super.

This concentration of returns to a small number of stocks is heightening risks. Are the mega-tech stock prices themselves now “artificially” inflated and too expensive based on their actual earnings? The rest of the US market doesn’t look quite as strong as companies deal with the impact of rising interest rates, costs and wages all putting pressure on the bottom line. The difference between the top 5 and the rest of the market highlights the value of active management – Rest’s investment process across its diversified portfolios.