Since the end of March, there have been further developments with US tariffs that have impacted global share markets.

Rest’s Growth option returned -0.33% for the quarter, and 6.19% over the 12 months to the end of March 2025. The Balanced pension option, returned 0.24% for the quarter and 5.93% for the year.

Performance (%) |

3 months | 1 year | 10 years p.a. | Since inception p.a. |

|---|---|---|---|---|

| Growth (Super) | -0.33 | 6.19 | 6.40 | 8.29 |

| Balanced (Pension) | 0.24 | 5.93 | 5.90 | 7.36 |

Source: Rest, 31 March 2025. Returns are net of investment fees and tax, except Pension, which is untaxed. The earnings applied to members’ accounts may differ. Investment returns are at the investment option level and are reflected in the unit prices for those options. Returns for periods greater than one year are annualised. Past performance is not an indicator of future performance. Inception dates are 1 July 1988 for Growth and 13 September 2002 for the Balanced (Pension) option.

Click here to see the latest investment performance for all options

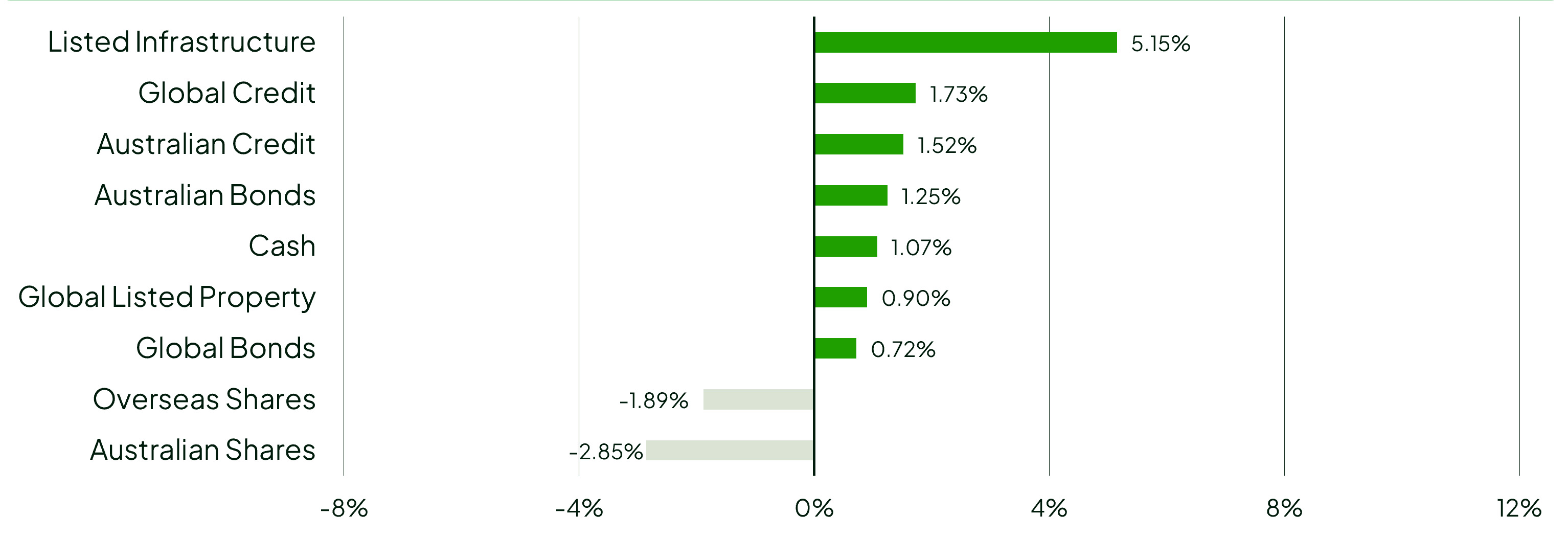

As we can see in the graph below, Australian and Global Shares detracted from performance, while several other asset classes, including Listed Infrastructure, contributed positively to returns.

Quarterly market asset class performance

Source: Rest and FactSet, 31 March 2025.

Indices used are Global Shares: MSCI All Country World Ex-Australia Equities Index with Special Tax (unhedged in AUD), ), Cash: Bloomberg AusBond Bank Bill Index, Australian Credit: Bloomberg AusBond Credit 0+ Yr Index, Australian Bonds: Bloomberg Ausbond Government 0+ Yr Index, Australian Shares: ASX300 Total Return Index, Global Bonds: Bloomberg Global Treasury Index (Hedged AUD, Global Credit: Bloomberg Global Aggregate - Corporate Hedged to AUD, Global Listed Property: FTSE EPRA/NAREIT Developed ex Australia Rental Hedged to AUD, Global Listed Infrastructure: FTSE Developed Core Infrastructure 50/50 Index Hedged to AUD.

What happened over the quarter?

The US announced a range of tariffs across February and March, focusing largely on imports from Canada, China and Mexico. All aluminium and steel exporters to the US, including Australia, had 25% tariffs imposed on their goods. These “trade wars” unsettled global markets as pricing impacts flowed through to companies, countries and share markets in particular. As a result, major share markets around the world, especially in the US, took a tumble during the first quarter.

What are tariffs?

Tariffs are a tax imposed by governments on imported or exported goods, often used as a tool to protect a countries’ industries by making imported goods more expensive to favor products made locally. The additional cost is often passed onto customers which can increase prices and cause inflation.

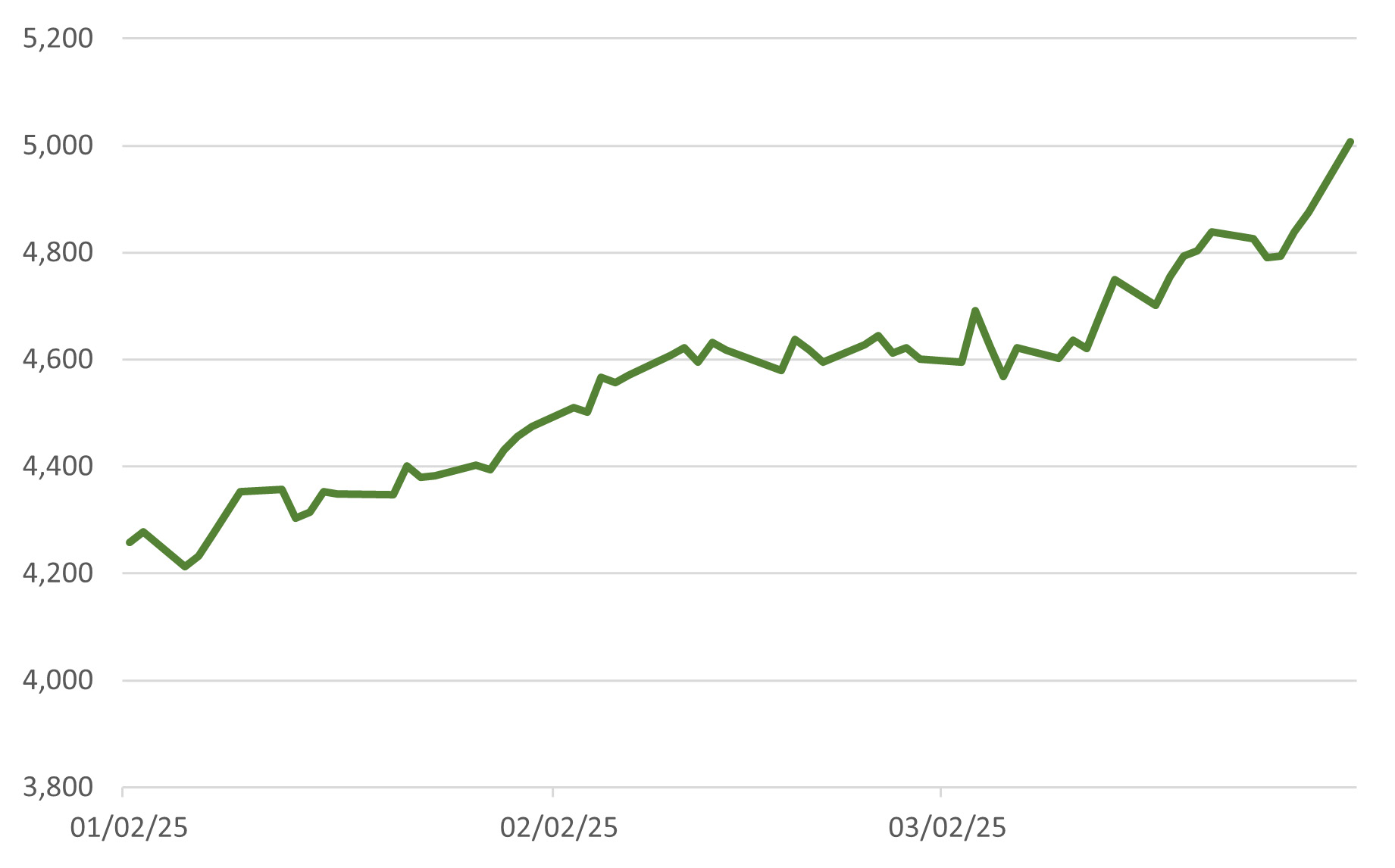

There is of course, some positive news to help counter the ensuing volatility, and balance out returns. The asset class graph above and the gold graph below both highlight that when some asset classes like Global Shares underperform, others may outperform, delivering returns from different sources. This is exactly why diversification in your super fund is so important – it can help smooth out the journey.

China’s share markets have performed consistently well across 2024, and our portfolios have benefitted from this exposure. Furthermore, over the last quarter, European, Japanese and Indian stock markets have also performed strongly as the main US stock market, the S&P500, fell 2%, supporting some resilience in our global shares portfolio.

Meanwhile, the gold price continued its amazing run. Following its best quarter since 1986, it reached an all-time high of AUD$5028/oz at the end of March.

Gold price ($AUD/ozt)

Source: Rest and FactSet, March 31, 2025.

Continuing the positivity in Australia, inflation figures are moving in the right direction, and our central bank, the Reserve Bank, lowered the cash rate in February for the first time since November 2020. This provided a little cost of living relief, especially for mortgage holders.

What’s the outlook?

As we head further into an uncertain and volatile 2025, it’s worthwhile remembering:

- Market volatility may create buying opportunities at the right price; and

- Super is typically a long-term investment - share markets often go up and down in the short term, but they have historically delivered strong growth over the long term.

At this point in time, we believe the influence of US tariffs is still to wash through global markets. We expect volatility to remain in investment markets for some time as US policy uncertainty remains high. But as we’ve noted above, diversification often holds the key, with different and varied return sources contributing to keep our diversified portfolio returns more stable in a tricky environment.

At Rest, our investment team continues to keep track of risks and opportunities that abound across investment markets and navigates the ups and downs that inevitably flow from political and market uncertainty. We know it can be worrying when markets fall but our investment team has navigated global volatility many times and it is normal for markets to go up and down.

If you’d like to know more about super, markets and volatility, please check out these links for more info:

- https://rest.com.au/why-rest/about-rest/news/dip-in-super-balance

- https://rest.com.au/investments/understanding-investments/super-balance-up-and-down

And if you need a little advice, we’re here to help.

You can reach out to a Rest Super Specialist or have a look at our digital advice tool.

Check your investment choice is right for you

You can spend 7 minutes using our online Investment Choice Solution that will ask you some simple questions to help you learn more about your investment risk profile and assist you in making a decision on which Rest investment options may be right for you.