What happened over the quarter?

For the quarters ended in March and June 2024, we noted the outsized performance of the US technology sector in global share markets. In the September quarter, however, companies from other sectors, like communication services and utilities, also reported strong earnings growth and lifted the share market overall. (Earnings measure a company’s net profit, and earnings growth measures the increase or decrease in a company’s net profits over time.)

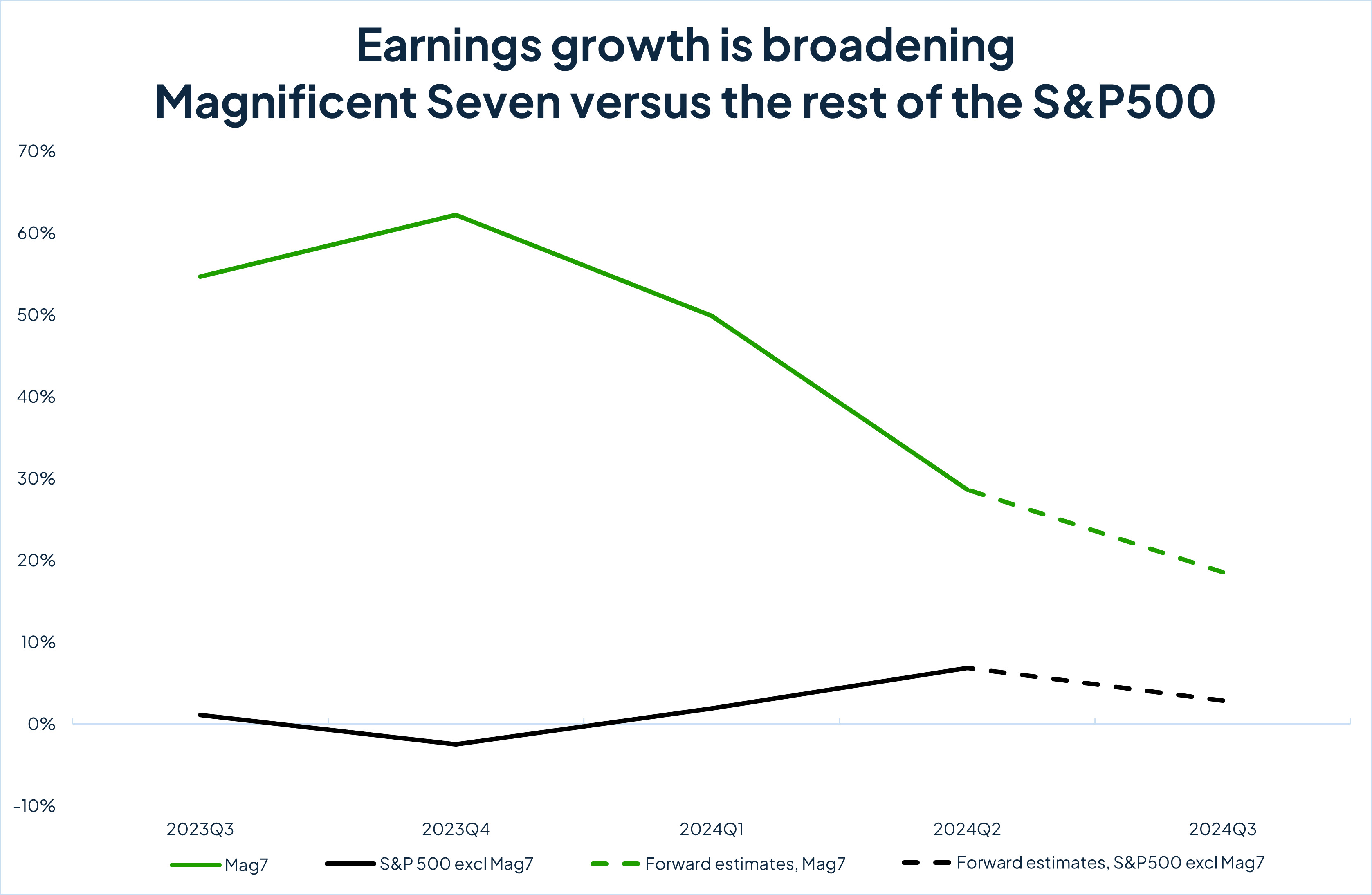

In the graph below, the group of very large US tech companies known as the Magnificent 71 (represented by the green line) had a much larger collective growth in earnings earlier this calendar] year than the collective earnings growth of the other 493 companies in the S&P500 index (shown by the black line). Over the course of the calendar year, that earnings growth has come down relative to the earnings growth of the rest of the S&P500, which has risen.

The gap between the growth in earnings of the Magnificent Seven technology stocks and other companies in the S&P500 index has narrowed. (Earnings growth is estimated for 2024Q3, the quarter to 30 September 2024.) Source: FactSet, September 2024.

Does this mean these tech stocks have underperformed? Not at all. Notice their earnings growth rate is still expected to be over 20% at the end of the quarter . The earnings growth of the other companies in the index, however, went up over the March and June quarters .

This broadening of company earnings means there is less concentration of the small number of companies driving the US share market overall, which points to a healthy US economy that can continue to expand. This is good news for investment options invested in US shares.

In Australia, shares also performed well, led by the banking and finance sector, as fears of a recession reduced. The higher interest rate environment began to bring inflation down while immigration and government support have propped up the economy.

Inflation has also been moving down in other major developed-market economies. Central banks in Europe, the United States, China, Canada, and New Zealand lowered their interest rates during the quarter. A notable exception was Australia, where the Reserve Bank of Australia in September was not yet confident that inflation (annual CPI) will return sustainably to the target band of 2-3%.2