While investing, especially within super, should generally take a long-term approach, prolonged periods of market volatility and even market falls can slow down progress towards your goals. In the case of super, that is growing your retirement nest egg.

Investment markets, particularly share markets, move constantly in response to news, politics and economic outlooks to name a few factors. Sometimes they move rapidly and dramatically – especially when the news is unexpected.

As a result, markets have the potential to be persistently volatile in times of economic and or geopolitical uncertainty.

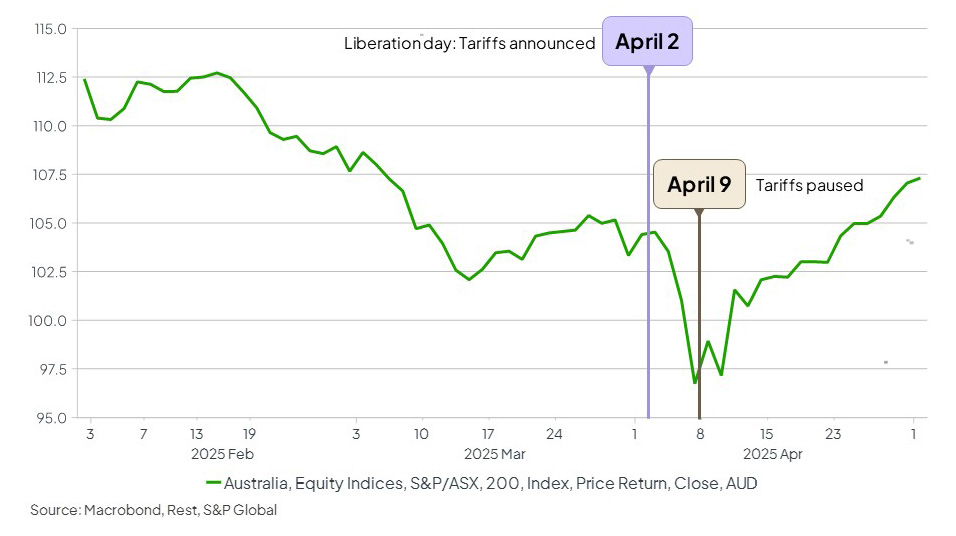

An example of this was the market reaction in April 2025. On 2 April, the U.S. administration announced a raft of tariffs affecting global trade. These announcements on 2 April, known as “Liberation Day”, unsettled global markets as the potential pricing impacts flowed through to companies, affecting the outlook for share prices.

Markets reacted strongly because the tariff news was bigger and more widespread than markets had anticipated. During the month, the main Australian share market index, the ASX 200 plunged as much as 10.2% over a few days, but then bounced back 13.4%, to finish the month up 3.6%. It’s a good reminder that markets can sometimes recover very quickly, and that market volatility means markets go down and up. But even with short-term volatility, it can take a little time for your super balance to show the recovery.

The short-term volatility in April 2025 where the market went down quickly, but also went up quickly, is different to the Global Financial Crisis (GFC) in 2007. The GFC caused massive falls in the share markets with a prolonged “bear market” of 17 months (October 2007 to March 2009) afterwards.

Share market examples include (peak to trough):

- S&P500 with a 57% fall

- S&P/ASX200 with a 54% fall

Source: FactSet, Rest.

These falls were dramatic, and there was a global recession afterwards which hindered the market recovery. Unlike short term volatility, these big falls can take a long time to recover from.

If you’ve been looking at your account balance recently, you’ve probably noticed that even short- term dips can take a bit of time to recover, despite markets improving.

The power of compounding & drawdown risk

(Sorry – there’s a little maths)

Long term investors aim to harness the power of positive compounding – where returns added to your balance help it grow over time.

However, there’s also a negative effect from compounding. Negative returns have a bigger impact on investment performance than positive returns. That’s because when your investment drops in value, you need a larger percentage gain to recover the loss - for example, a 20% loss requires a 25% gain just to break even (refer to table below).

| -10% |

$90 |

11% |

| -15% |

$85 |

18% |

| -20% |

$80 |

25% |

| -25% |

$75 |

33% |

Source: Rest calculations.

If you look at the middle column, it makes sense. When your investment starts growing again, it’s starting from a lower base.

A 10% gain on $100 will give you $110, but a 10% gain on the lower starting point of $90 will only be $99. It becomes clear that a gain bigger than the original loss is needed to get back to where you were in the first place.

You can also see in the table that the percentage gain needed to recover from a loss gets even bigger as the loss gets bigger. This is because the gain needed is “exponential” (like the Richter scale we use to measure earthquakes). This also explains why investors were “underwater” for such a long time following the GFC.

Got it! Is there anything I can do with my super to avoid this?

In investing, sometimes you need to take the good with the bad. A case in point - while shares are higher risk and generally more subject to short term falls and market volatility, they are also more likely than other asset classes to help grow your retirement nest egg because they are one of the best asset classes for delivering long-term growth.

A large exposure to shares in your super option is not necessarily for the faint hearted! It all depends on your personal tolerance for risk, your goals and your time to retirement. The best amount of exposure to shares in your super is as individual as you.

Luckily, Rest has an online tool where you can figure out how much risk you’re okay with.

You’ll find a lot depends on your age and your time to retirement. If you’re young, you’ve got lots of time to recover from market volatility or even large falls. If you’re getting closer to, or in retirement, you’ll need to think about your time to recovery. This is why we talk about investment timeframes and why they’re strongly linked to your risk tolerance and to your investment option choice.

And finally, let’s not forget about diversification. Diversification remains the key to delivering returns through market ups and downs. Investing across a range of public and private markets assets, and a large number of individual assets helps keep Rest’s diversified portfolios balanced, with a smoother journey and some resilience when markets are turbulent.