On average, women in their early sixties retire with around 28% less super than their male co-workers.^

There are several factors that may contribute to women retiring with less than men, from long periods out of the work force, to many women working part-time or casual hours. In fact, last year women accounted for 87%* of primary carers leave used.

The majority of Rest’s members are women, and given the obstacles many women face, Rest is a strong supporter of helping to educate our members on the ways they can help even the score and create a more equitable retirement.

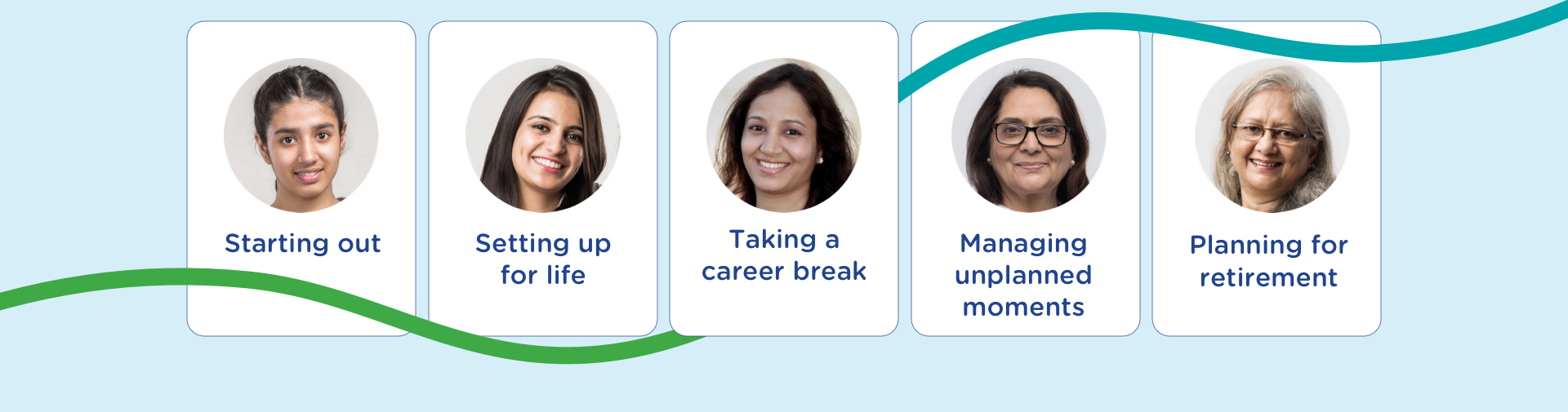

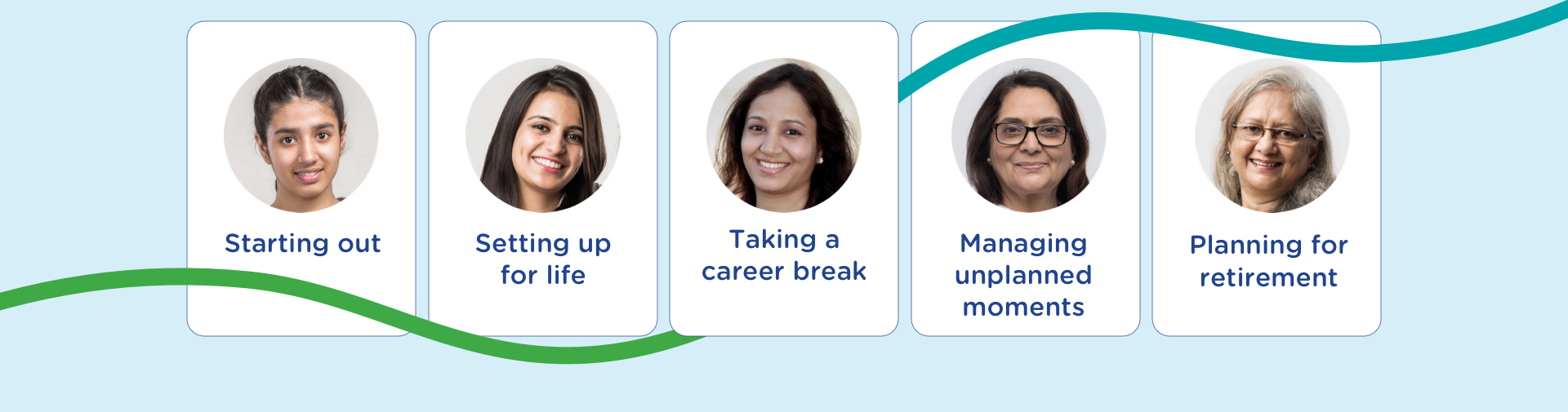

This year, in recognition of International Women’s Day, we’re holding an online event that has been tailored to help members learn more about super through the specific stages of a woman’s life.

Sally’s Story

We’ll journey with Sally as she starts her first job, receives her first super payment, continues to move throughout her career building positive financial habits, takes time out of the workforce to start a family and navigates some of life’s unexpected moments, all the way through to readying herself for retirement.

Learn how Sally makes her super work for her, so that she can maximise her retirement outcomes.

If you’d like to attend or share the event with your team, you can simply click the button below to register.

When it comes to a fair and equitable retirement, everyone deserves a Fair Play.

^In 2021, the median super balance for men aged 60-64 years was $204,107 whereas for women in the same age group it was $146,900, a gap of 28 per cent. The Gender Superannuation Gap, Addressing the options KPMG, 2021.

*Australia’s Gender Equality Scorecard 2021-22 Employer Census, WGEA, December 2022.