The Banking Brief

Skip ahead to read about the Australian banks and what this all means for your super

Born in the USA

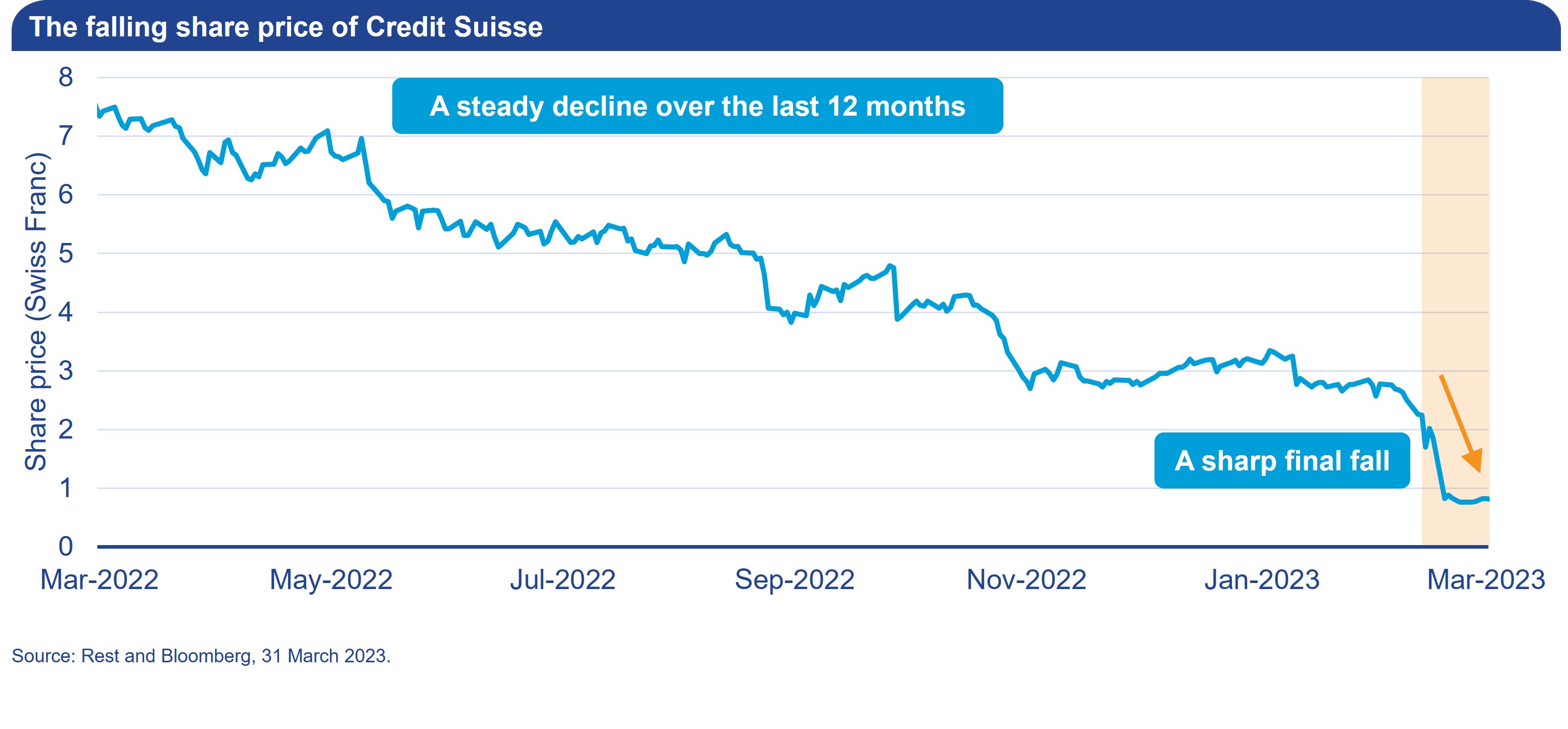

It all started with the US regional banks. In early March, SVB became the largest US bank to collapse since the gloomy days of the 2008 global financial crisis (GFC). We know we talk about the importance of diversification a lot, and the failure of SVB highlights again why diversification matters – it’s not limited to just super investments!

As the name Silicon Valley suggests, the bank’s customer base was focused on tech startups. This meant that a large chunk of the deposits held at SVB were from just this industry.

Over the last 12 months, rising interest rates have caused a lot of pain for these startups as they received less funding from investors. This has meant that many startup companies have needed to withdraw their deposit money from banks to cover expenses. Unfortunately for SVB though, as their customer base was very concentrated, many customers withdrew their deposit money at the same time (otherwise known as a ‘bank run’). So, just like when you are investing, a lack of diversification does mean more concentration risk.

A bank run can be very problematic as banks often have this deposit money tied up in other investments and they can’t return it easily when a lot is requested at once. This led to significant financial losses for SVB and ultimately its demise.

Two other smaller regional banks (Silvergate Capital Corp and Signature Bank) also announced they would be winding up operations within that same week. As with SVB, these banks had a poorly diversified customer base and were major banks for cryptocurrency companies. So again, the lack of diversification left these regional banks very vulnerable to a bank run if cryptocurrency markets struggled (newsflash: they did). These banks therefore also failed as they were unable to meet the demand for deposit money.

The US Federal Reserve has now stepped in to guarantee bank deposits at SVB and Signature, providing some comfort to both their customers and markets.