Our investment options

You have a choice

Did you know that you can either choose how your super is invested or if you don’t want to choose, your super will be automatically invested in the default investment option? Learn what to consider when deciding what works for you.

How market volatility affects your super

You may have noticed your account balance recently fluctuate due to market changes. Learn more about how market volatility affects your super.

Investment performance

With four core investment beliefs we’re focused on growth for our members. Our Growth option has delivered 8.36% pa since we were founded in 19881.

1. Growth's returns are the compound average effective rate of net earnings since inception to 31 December 2025. Past performance is not an indicator of future performance.

Switching investment options

How to switch your investment options

We realise your investment needs may change over time, so you have the option to switch your investment choice at any time.

Not sure which option is right for you?

Our Investment Choice Solution tool can give you recommendations on which Rest investment option is right for you.

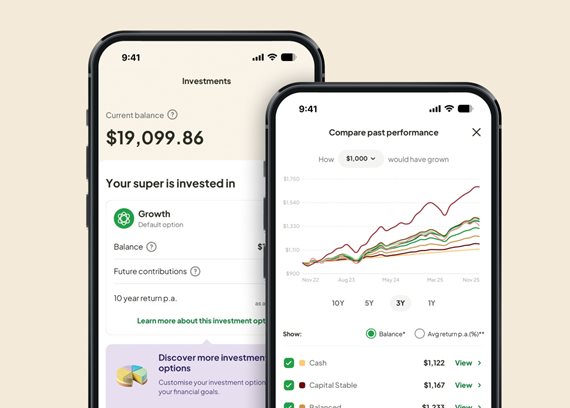

All your investments info in one place in the Rest App

See your investment options at a glance in the new Investments Hub in the app. It’s easy to use and puts you in the driver’s seat.

- Learn about investments with bite-sized explainers

- Explore and compare performance of each investment option

- Get support with Rest’s digital advice tools or book a call with a Super Specialist

- Switch investment options