After the US election in early November, the US share market had its best month of the calendar year. The Republicans emerged as the clear winners, with control of both the House and Senate, meaning it will be easier for them to implement new policies. Share markets performed well, driven by optimism about proposed policies such as tax cuts and deregulation.

However, this positive momentum for share markets faced a setback in December following indications from the US central bank that it might not cut interest rates in 2025 as much as initially thought. Despite indications of inflation coming down from high levels, it remains above the central bank’s target, meaning that the central bank needs to tread a careful path when considering further rate cuts to help prevent inflation from reigniting. Bonds also reacted negatively to these developments after already experiencing a tough start to the quarter.

Globally, other central banks, including those in the Europe, Canada, and New Zealand, continued with rate cuts during the quarter, contrasting with the Reserve Bank of Australia (RBA), which has not yet reduced rates. With high inflation persisting and exceeding the RBA's target range, the RBA has been cautious about lowering rates too quickly. Following its December meeting, the RBA indicated it’s becoming more confident in the downward trend in inflation, sparking speculation about a possible rate cut in the first half of 2025. Still, such a decision will also depend on other economic indicators like employment numbers, so mortgage holders might not be able to relax just yet.

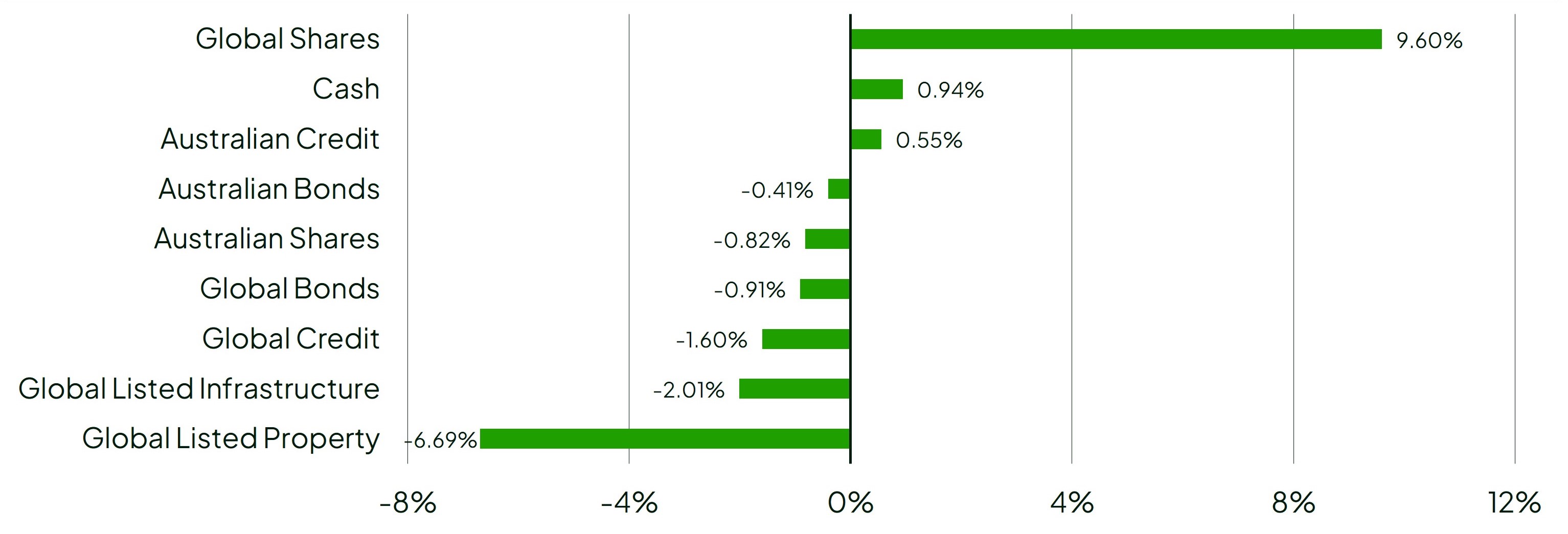

Despite mixed market results, investing across a range of different asset classes (diversification) worked out well for all of Rest's diversified options, which still produced positive returns overall for the quarter, even against the backdrop of an eventful quarter that included US elections and continuing regional conflicts.