Investment update: September 2025

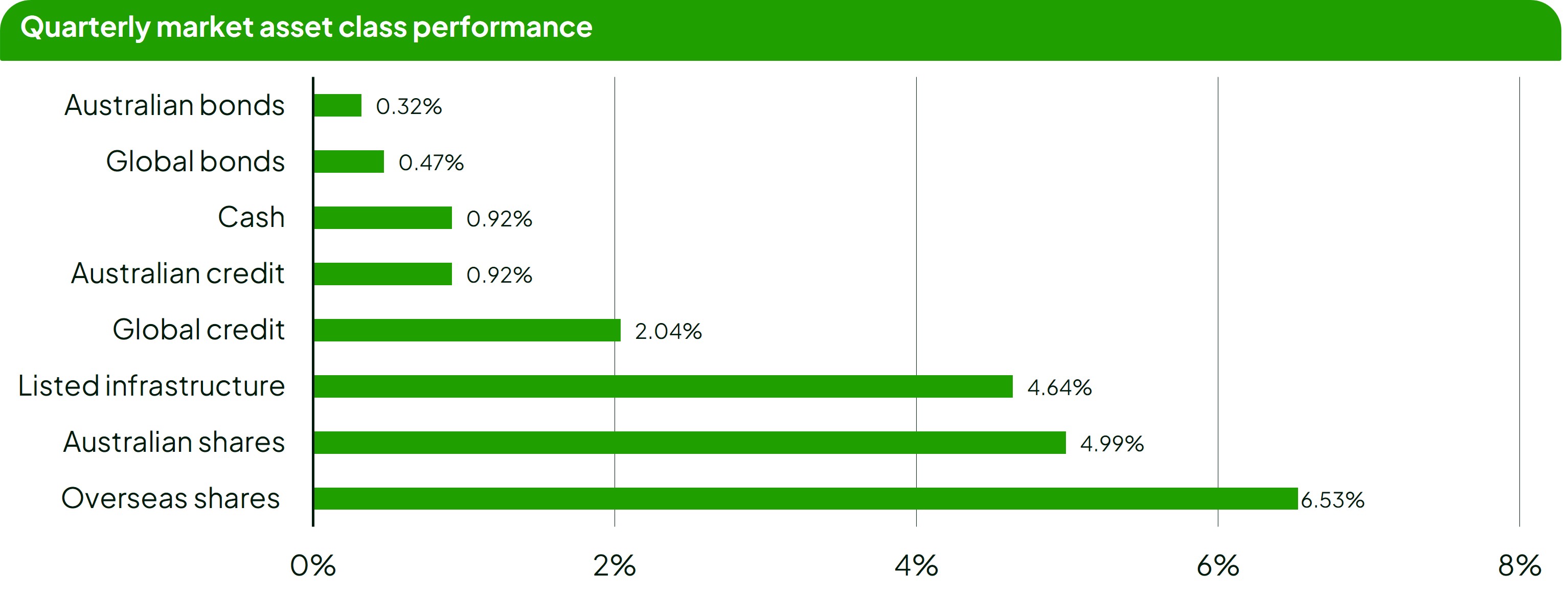

Rest’s Growth (Super) option recorded strong gains in the September quarter, as all major asset classes (shown below) delivered positive returns over the period.

For the quarter ending 30 September 2025, Growth returned 3.73% and the Balanced Pension option returned 3.15%.

| Returns (%) | 3 months | 1 year | 10 years p.a. | Since inception p.a. |

|---|---|---|---|---|

| Growth (Super) | 3.73 | 10.19 | 7.39 | 8.38 |

| Balanced (Pension) | 3.15 | 9.31 | 6.62 | 7.48 |

Source: Rest, 30 September 2025. Returns are net of investment fees and tax, except Pension, which is untaxed (other than returns for the Transition to Retirement Pension which from 1 July 2017 onwards are also net of taxes). The earnings applied to members’ accounts may differ. Investment returns are at the investment option level and are reflected in the unit prices for those options. Returns for periods greater than one year are annualised. Past performance is not an indicator of future performance. Inception dates are 1 July 1988 for Growth and 13 September 2002 for the Balanced (Pension) option.

What happened over the quarter?

Global investment markets delivered strong returns over the quarter, driven by steady economic growth and reduced concerns about trade disruptions. While uncertainty remains, especially around inflation and global policy decisions, overall economic conditions were supportive for major investment markets.

Source: Rest and FactSet, 30 September 2025.

Indices used are Global Shares: MSCI All Country World Ex-Australia Equities Index with Special Tax (unhedged in AUD), Cash: Bloomberg AusBond Bank Bill Index, Australian Credit: Bloomberg AusBond Credit 0+ Yr Index, Australian Bonds: Bloomberg Ausbond Government 0+ Yr Index, Australian Shares: ASX300 Total Return Index, Global Bonds: Bloomberg Global Treasury Index (Hedged AUD, Global Credit: Bloomberg Global Aggregate - Corporate Hedged to AUD, Global Listed Infrastructure: FTSE Developed Core Infrastructure 50/50 Index Hedged to AUD.

In the United States, data released during the quarter, reflecting economic activity from earlier months, showed that the economy continued to grow, though some early signs of softening momentum began to appear. In response, the US central bank (the Federal Reserve) cut interest rates in September to help support the economy. One key driver for the cut was concerns over a slowing labour market and rising unemployment claims. These indicators suggested that momentum in the economy might be fading, prompting the Fed to act in an effort to avoid a sharper slowdown.

At the same time, inflation remains above the Fed’s long-term target, creating a balancing act for policymakers. The rate cut gave share markets a boost, with the US share market (as measured by the S&P 500) rising more than 8% over the quarter. Bond markets also responded positively to the rate cut, with US government bonds delivering modest gains.

One theme that continued to attract attention over the quarter was tariffs, that is, taxes placed on goods imported to the US. The US imposed new tariffs on items like copper and pharmaceuticals and raised tariff rates on Canadian imports. While these measures can increase costs for businesses and consumers, the overall impact on global growth has so far been less severe than originally expected, and some subsequent trade deals helped ease concerns. However, we think the full effect of these tariffs on company earnings and prices may still take time to show up.

In Australia, the economy is showing some signs of improvement. People are starting to spend more, and the housing market is picking up, helped by prior interest rate cuts this year. Inflation ticked up slightly in August, which prompted the Reserve Bank of Australia (RBA) to hold the cash rate steady at 3.60% during its September meeting. Having already cut rates three times earlier in the year, we expect that the RBA will be closely watching inflation and economic data before making any further moves.

Outside of Australia and the US, other regions also performed well. In Japan, the share market rose by over 11%, supported by strong corporate earnings and recent corporate governance reforms. China’s share market also had a strong quarter, rising more than 12%, thanks to targeted government support and improving consumer confidence. In Europe, results were mixed as some countries, like France, faced political uncertainty, which weighed on both share and bond markets.

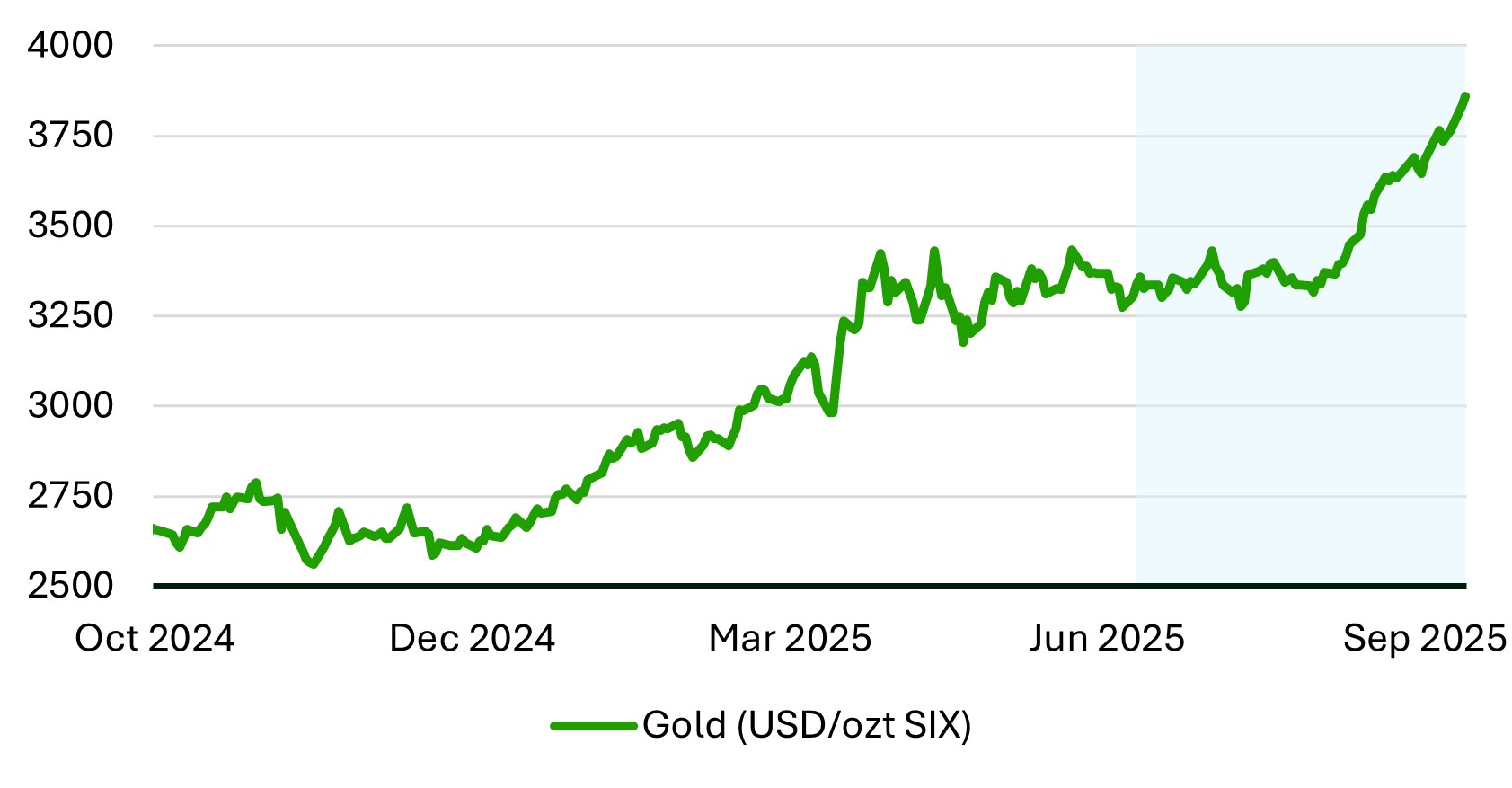

Gold had a standout quarter, reaching record highs after surging over 16%. This strong performance was driven by ongoing global economic uncertainty and expectations that interest rates may stay lower for longer. Investors often turn to gold when markets are uncertain. Lower interest rates also make gold more appealing because it doesn’t pay interest or income, so when rates are low, gold becomes more competitive compared to other investments that do. Additionally, a weaker US dollar also helped, making gold cheaper for international buyers. Since gold is priced in US dollars globally, a weaker dollar tends to boost demand and pushes prices higher.

Gold prices hit a record high over the quarter

Source: Rest and FactSet, 30 September 2025

The strength in gold prices contributed to a strong quarter for Australian resource companies, which led gains in the local share market and reflects strong global demand for gold and other resources. The Australian share market performed well over the quarter, with the ASX 300 reaching a record high in August. Although the market eased slightly in September, it still finished up 4.99% for the quarter. Our investment options with exposure to Australian shares benefited from this strong performance.Outlook

Looking ahead, global economic growth is expected to remain positive, though potentially at a more modest pace than current levels. Inflation is expected to stay above historical averages, which could lead central banks to take a more cautious stance. Geopolitical uncertainty and ongoing trade tensions, including tariffs, continue to pose risks to global growth and investor confidence.

After a few strong years for share markets, we expect future returns may be more moderate. Even so, company earnings remain generally positive and are holding up well.

In a more uncertain environment, we believe diversification and a focus on high-quality assets are especially important. Our diversified portfolios have shown resilience through challenging market conditions, supported by our long-term investment approach, emphasis on quality, and ability to build well-balanced portfolios.

While markets can rise and fall in the short term, these movements are a normal part of investing. Superannuation, for most people, is a long-term investment and staying focused on long-term goals while maintaining a diversified strategy can help smooth market fluctuations and grow retirement savings over time.