October 31 2025

Loading...

If you’re planning to retire in Australia, you may be factoring in receiving the government Age Pension. So, it makes sense to be thinking about its future longevity.

There’s little evidence today to suggest the Age Pension will stop in the foreseeable future.

When reading this article, please keep in mind that while the Age Pension is unlikely to stop in the foreseeable future, your eligibility may change over time.

Why the Age Pension is unlikely to stop in the foreseeable future?

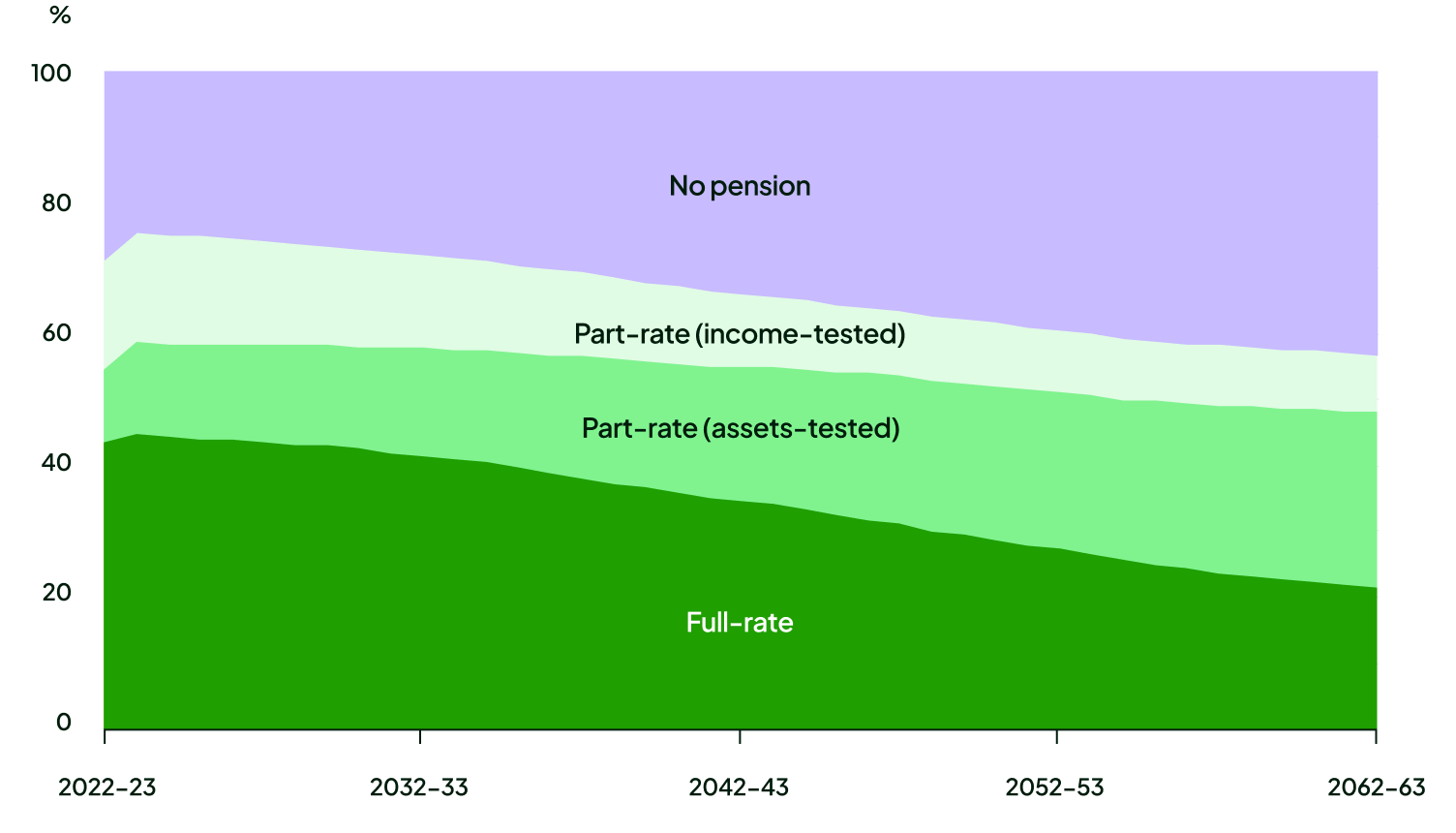

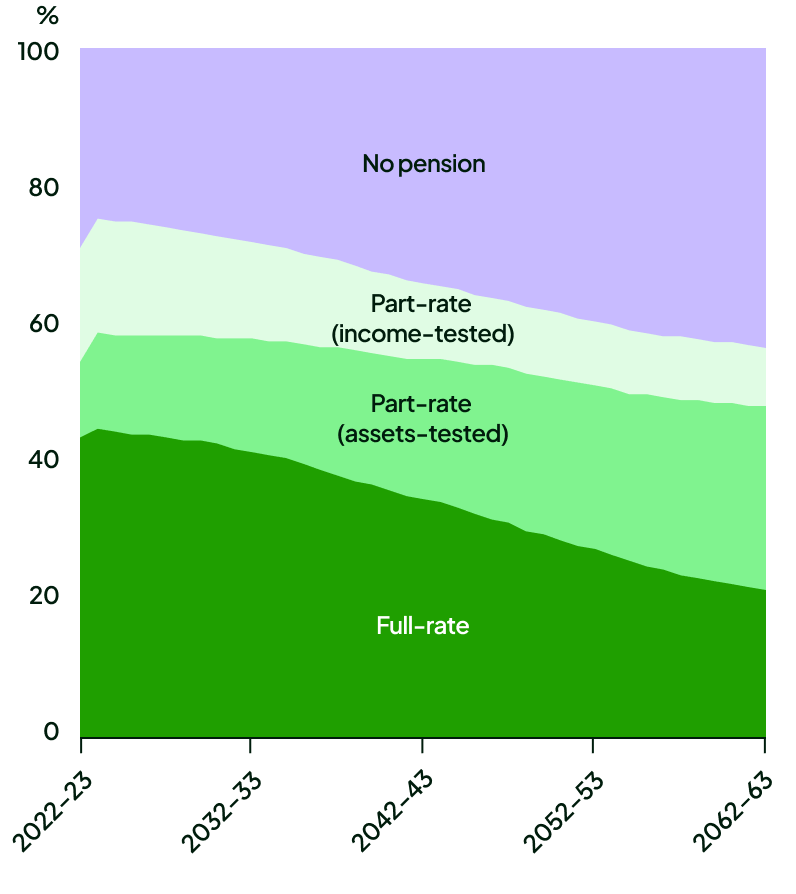

Persons of Age Pension age or over, by pension category

Note: The increase in 2023-24 is due to the Age Pension eligibility age increasing from 66.5 to 67 years old, which affects the measure of 'person of Age Pension age'.

Worried about how much you need for retirement?

It always helps to know how much money you’ll need for a comfortable retirement. Luckily, that’s where The Association of Superannuation Funds of Australia (ASFA) comes in handy.

ASFA provides estimates of how much couples and singles aged 67 would need in super for a comfortable or modest retirement (as shown in the below table).

Think of these numbers as a good starting point. You should also consider your lifestyle, average life expectancy, and how much money you’ll need to handle life’s speed bumps when planning your retirement. Our Retirement Lifestyle Budget Calculator can help you here.

Keep in mind a comfortable retirement includes things like going out to eat, international travel once every seven years, and private health insurance. A modest lifestyle covers the very basics and limited leisure activities. Both figures assume you own your own home outright.

| Single |

$595,000

|

$100,000 |

| Couple |

$690,000 |

$100,000 |

| Single |

$595,000

|

| $100,000 |

| Couple |

| $690,000 |

| $100,000 |

Source: ASFA Retirement Standard December 2024 quarter.

Note: Both budgets assume that the retirees own their own home outright and are relatively healthy. All figures in today’s dollars using 2.75% AWE as a deflator and an assumed investment earning rate of 6 per cent. The lump sums required for a comfortable retirement assume that the retiree/s will draw down all their capital and receive a part Age Pension. The fact that the same savings are required for both couples and singles for a modest requirement reflects the impact of receiving the Age Pension.

How much super will I have when I retire?

Rest offer calculators that can show you an estimate of what your future super balance might be.

Keep in mind things can change, and the results of these calculators serve as a rough guide only.

Rest members can also perform a free Retirement Health Check. In a few simple-to-follow steps, you’ll have a projected super balance, helping you get the most from your account.

You can find out how much super you have today by logging in to our app. If you’re not with Rest, check to see if your super fund has an app. There’s a good chance you’ll find your super balance in there.

How to plan for your retirement

We’ve all daydreamed about our retirement at one point. But have you ever stopped to consider how to get there? Most retirements are surprisingly within reach.

To put your plan together, there’s a few things to consider. Just think: ‘what’, ‘when’, and ‘how much’?

‘What’ involves figuring out the things you’d like to do or have during your retirement. A holiday every year, a garden plot, or a golf-membership and cart hire? It’s what your vision for retirement looks like.

‘When’ is when do you want to retire. How old will you ideally be? How long does your super need to last for? This is important because it lets you know how long your retirement money needs to last for. It’s the answer to ‘Will I need an extra $50,000 if you want to retire at 65 instead of 67.’

Lastly, ‘how much’ involves figuring out the amount you’ll need to both afford the things you want, and last for as long as you need it. From there, you can look at where that money will come from.

For a more in-depth look at planning your retirement, read this article. Just know that it’s always good to plan.

Rest’s financial advisers can help you put a plan together

Whether you’re preparing for retirement with or without the Age Pension, or just looking for help understanding anything about your super, Rest’s advice page offers tools and access to financial advice that can guide you through what to expect.

Best of all, Rest Members can ask a specialist about super by booking an obligation-free call today – there are no costs to speak to a super specialist. If required, they can also arrange a meeting with a Rest Financial Adviser.^

^Rest Advice is provided by MUFG Retire360 Pty Limited ABN 36 105 811 836, AFSL 258145 (Retire360). Rest Advisers are staff members of Rest and provide advice as authorised representatives of Retire360. Rest Digital Advice is provided by Retire360. Rest Advice may be accessed by members without incurring additional fees for simple phone-based advice. An advice fee may be payable for complex advice and you should read the Rest Advice Financial Services Guide, which you can obtain by calling us on 1300 300 778, before accessing these services.

This information is issued by Retail Employees Superannuation Pty Ltd ABN 39 001 987 739 (Rest), trustee of Retail Employees Superannuation Trust ABN 62 653 671 394 (Fund). Any advice is general and does not take account of your personal objectives, financial situation or needs. Before acting on any advice or deciding to join or stay, consider its appropriateness for you and the PDS, FSG and TMD at rest.com.au/pds. This information is a summary only current as at 09/05/25.